COVID-19 could be an ingredient for change for food processing industry

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 12 November 2020 | Anna Overton | No comments yet

The impact of COVID-19 is shining a spotlight on the health and safety of employees in the food industry. According to Anna Overton from S&P Global Ratings, as stakeholders place increasing importance on such social factors, this could induce lasting change to how companies in the sector approach their workers’ safety.

Covid-19 could force the food processing industry to make changes , according to Anna Overton.

As the COVID-19 pandemic continues to spread, emphasis on the health and safety of the food processing industry and its employees is intensifying. Among the most mature and competitive globally, the sector has long benefitted from many unpriced environmental and social externalities. That said, a shift to incorporate environmental impacts into the true cost of food has become more apparent in recent years, but the pandemic is serving to elevate social factors as a key consideration too.

With stakeholders along the supply chain (including consumers and regulators) demanding change, the sustainability and ultimate financial success of food and beverage companies will lie, at least in part, in their ability to manage these expectations and address these factors. But how equipped are players in the food processing industry to implement these changes, while simultaneously remaining competitive in the long term?

A need for change

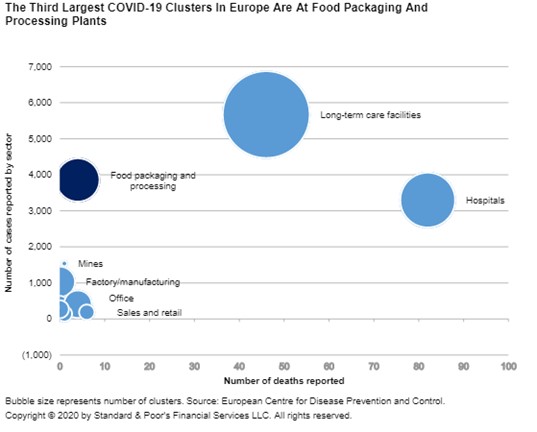

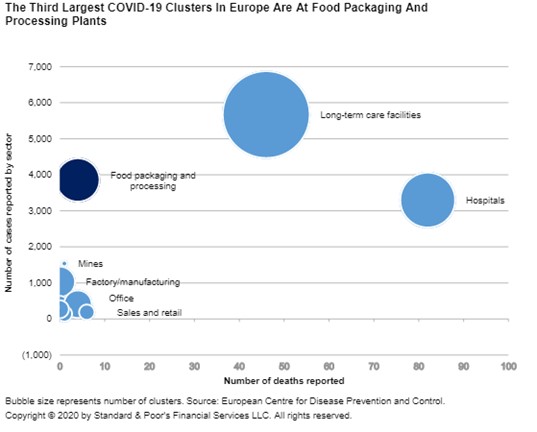

The COVID-19 pandemic has undoubtedly shone a light on social factors across all sectors. For the food processing industry, scrutiny on social factors, such as the workforce’s health and safety, is particularly prevalent – not least because of the wave of infections reported among food processing workers in recent months.

In the US, the federal government’s declaration naming food and agriculture industry workers as part of the country’s essential workforce during the pandemic means that they continue to face health and safety risks from their workplace.

National infection rates point to similar risks for workers elsewhere in the world: in Germany at the Tönnies factory in Rheda-Wiedenbrück, 1,500 of 7,000 employees tested positive for Covid. This outbreak, in what is the largest meat plant in Europe, triggered the lockdown of an entire region and demonstrations by residents and animal welfare activists. Meanwhile, outbreaks have been reported in 56 percent of Ireland’s meat plants – and in Brazil, unions claim that around 20 percent of the sector’s workers have been infected.

Stakeholder scrutiny is increasing

As well as resulting in temporary plant closures, which will likely impact the creditworthiness of these companies, these infection rates have also caused the workplace practices of food processing plants to be called into question by stakeholders along the entire supply chain, from regulators to consumers.

The high rates of infection have drawn the attention of the media, unions and human rights groups across the globe – particularly as, only months earlier, public health officials posted recommendations on how to reduce the risk of transmission.

While regulatory oversight of food processing prior to the pandemic focused mainly on preventing food contamination and the spread of food-borne disease, regulatory authorities are now reviewing the health, working conditions and treatment of the food processing industry’s workforce.

Meanwhile, for consumers, the pandemic seems to have strengthened their concerns about product safety and employee health. According to McKinsey, 20-25 percent of consumers in developed markets are researching food brands and products before purchase, and list healthy, hygienic packaging and the welfare of employees as the top decision-making considerations. In emerging markets, the figures exceed this, with 40 percent, 35 percent, and 45 percent of consumers in India, South Korea, and China respectively, citing hygienic packaging and employee care as priorities.

In the US, a specific social issue has emerged, with a US Centers for Disease Control and Prevention survey revealing the extent of exposure of racial and ethnic minorities to health and safety risks in the country’s meat industry. It found that BAME workers accounted for 87 percent of confirmed Covid cases at meat processing plants between April and May.

Long-term change on the horizon

We expect that, as a result of the pandemic-induced scrutiny on the social beliefs and practices of companies, the food processing industry is unlikely to maintain the pre-pandemic operational status quo. For food producers, we believe the only way forward is modified pricing and operational structures, and discontinuation of certain products.

This change will likely be driven by Government agencies and regulators, seeking to limit the spread of contagious diseases. The German federal Government has already announced a ban on contract and temporary workers at meat plants from January 2021, requiring meat processors in Germany to directly employ all staff, usually at a higher cost than for agency workers.

This ban was in response to a suggestion by the European Federation of Food Agriculture and Tourism Trade Unions that this may be a key contributor to the high infection rates in the industry across the region. In the Netherlands, a similar move is also on the cards, with FNV, the largest trade union, demanding direct employment of food processing workers.

But as well as adhering to enhanced regulatory guidelines, brands pursuing growth will need to differentiate positively on social factors to capture market share.

Indeed, such changes are already being observed. Tönnies, for example, has introduced new hospital-grade air filters into its ventilation systems, while other companies have shortened work shifts, thereby slowing production lines, and have imposed social-distancing conventions for workers.

Lasting impact

In all likelihood, most developed markets will see public health policies mandating more stringent rules for surface cleaning, hygiene, and social distancing at food processing plants in the future, regardless of how COVID-19 infection rates develop over the medium-term.

Companies will inevitably face increased operating costs, thinning margins, and unused capacity on an indefinite timeline, exacerbated by the prospect of workforce shortages as migrant workers remain shut out due to travel restrictions. But the food industry has long lagged behind other consumer goods sectors in adopting advanced technology such as robotic automation, and these changes may stimulate this transition.

Biography

Anna Overton is a Senior Director in the Corporate Ratings group of S&P Global Ratings in London. She is Analytical Manager for the EMEA Consumer Goods & Healthcare ratings and is responsible for more than 150 credit ratings, which are covered by analysts based in London, Paris, Madrid, Dublin and Milan. Anna joined S&P Global Ratings in 2000 as an analyst and has covered a number of industrial sectors, acting as a global industry focus team coordinator for leisure, media and entertainment and, subsequently, for the consumer goods and real estate sectors. She is also Chartered Fellow of the UK Chartered Institute for Securities & Investment and an Associate of the UK Chartered Institute of Bankers and holds a BSc (Hons) in Financial Services.

Related topics

COVID-19, Outbreaks & product recalls, Pathogens, PCR Technology