The future growth of liquid dairy in China

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 17 June 2018 | Jason Yu | No comments yet

China’s Economy in 2017 saw accelerated growth for the first time in seven years, in which consumer expenditure contributed the most to the GDP (ie, 58.8 per cent). The Fast Moving Consumer Goods market showed recovery, which suggest that Chinese consumers’ needs are still not being fully met. Kantar Worldpanel’s continuous tracking of 40,000 household panelists in China shows that healthy, convenient meal replacement and imported categories lead the growth, while categories with high sugar or high calorie levels saw continuous decline.

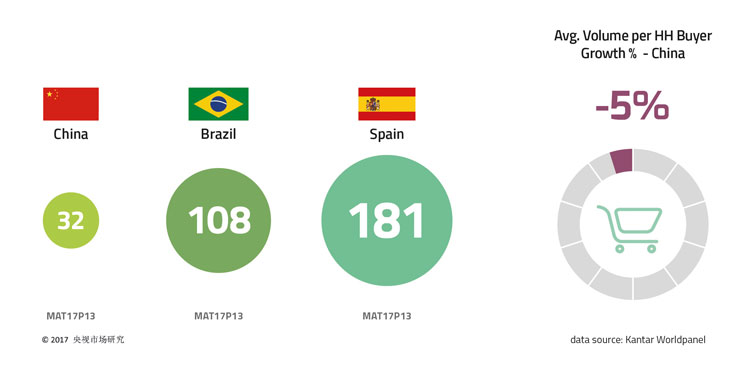

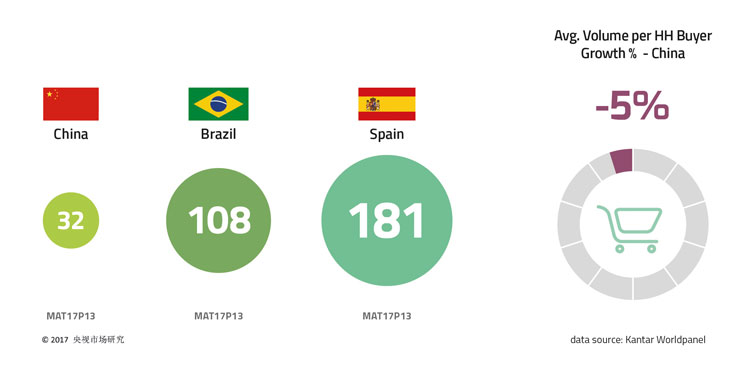

As one of the biggest categories, liquid dairy has the largest consumer base among China’s urban households – where penetration hits 99.6 percent. It experienced rapid growth in the last decade, but has encountered a bottleneck in the past few years – with growth slowing down in average purchase per household. Kantar Worldpanel data shows that Chinese consumers’ average purchase volume per household is only 18 percent that of Spain and 30 percent that of Brazil, so still has plenty of potential.

Apart from the above, there was a decentralised trend in China’s dairy market. Both high-end and basic categories were growing well (among ambient dairy: premium white milk and ambient yoghurt grew by 7.6 percent in value, basic white milk increased by 0.7 percent; among chilled yoghurt: premium yoghurt and premium label grew 16.4 percent and basic yoghurt grew 7.9 percent), while categories with middle pricing slumped considerably. The high-end products encouraged consumption upgrade, by enriching the basket choices and providing a better taste experience. Basic products, meanwhile, enabled consumers to build regular consumption habits by meeting their basic needs.

We are primarily seeing three growth models in the recent Chinese liquid dairy market:

1. Expansion into the less developed midwest area, which thus allows more people to buy

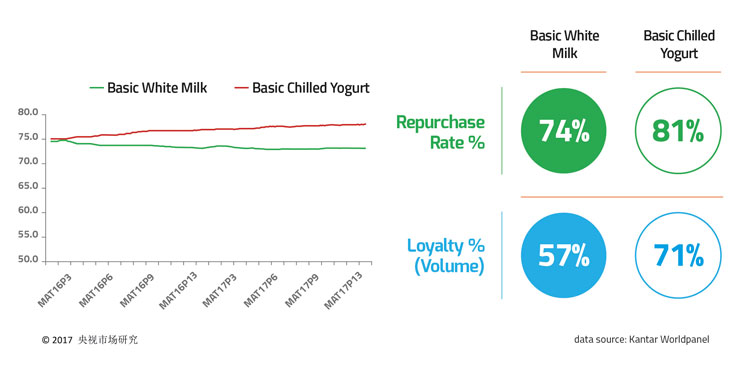

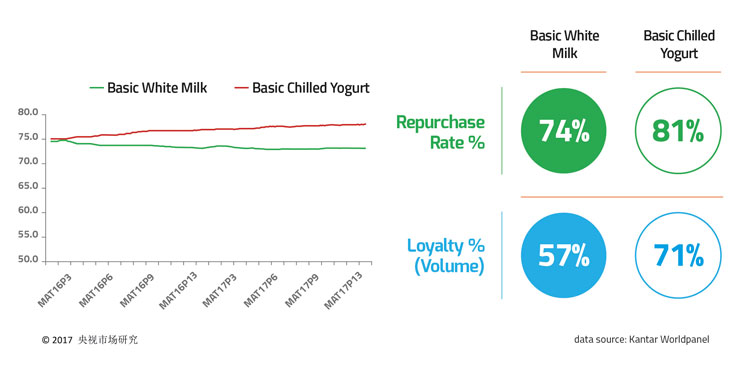

Kantar Worldpanel data shows that basic liquid dairy categories saw the highest consumption (73 percent for basic white milk, 78 percent for basic chilled yoghurt) and higher loyalty, so basic diary is the best choice for category penetration.

In Yunnan/Guizhou/Guangzhou, which saw relatively lower average purchases per household (50 litres per year, versus the national 56 litres per year), basic liquid dairy clearly increased in penetration (+1 percent) in 2017.

2. To develop more dairy consumption by meeting the consumer’s desire for greater convenience

Given the faster pace of life in China, the importance of meeting consumer needs immediately is becoming increasingly crucial for brands and manufacturers. Kantar Worldpanel data shows that the dairy sector is growing far more quickly in smaller supermarkets, convenience stores and via e-commerce channels. In 2017, total convenience channels grew by nine percent – higher than that of all the channels combined at two per cent. It is suggested, then, that manufacturers should increase their investment in convenient channels in order to allow consumers to purchase goods more easily and more conveniently.

Figure 1: Liquid Dairy, Avg. Volume per HH Buyer (Litre)

Moreover, new retail is developing quickly in China, which means new opportunities in liquid dairy. Thirty minutes after placing an order via the HeMa App, the products will have been delivered to areas within a three kilometre radius. Fresh food e-commerce outfits such as Missfresh and JD Daojia are becoming increasingly popular. Their liquid milk new delivery services means products can be delivered straight to the doorstep within two hours. In addition, manufacturers have the opportunity create more consumption instances and milk consumption opportunities, such as afternoon tea and meal replacement. Therefore, the new needs and 360° channels will motivate new growth potentials.

3. To encourage consumption upgrade, by introducing more innovations

To meet consumer’s upgrading needs, the big manufacturers have all made innovations across various areas: product quality, packaging, ingredients and consumption occasions, in order to catch buyers’ attention, stimulate their taste, and ultimately let consumers pay for the products of their own choice. Ambient yoghurt has experienced quick growth in the past few years; it has attributed to consumers’ category perception of containing probiotic bacteria, has excellent taste and free from cold chain logistics, and benefits from manufacturers’ high-end product innovations. These new products bring a whole new experience in taste, package and functions to consumers, whom are willing to spend more money on attaining these products. For instance, Ambrosia has launched a PET bottle product to expand its consumption opportunities; Mengniu’s new product, ZUO yoghurt, launched with unusual flavours (salty, bitter and with a hot taste), claims that it understands young consumers better; the category initiator Momchilovtsi launched Flowers Secrets, to recruit more young female buyers through, “drinking with flowers for facial and skin beauty”. These products both achieved the goal of self-upgrading and further brand rejuvenation.

Figure 2: Penetration %, China

Within the low-temperature yoghurt category, sales of luxury yoghurt have increased dramatically over recent years. In 2017, the growth rate of the luxury sector was nine times that of yoghurt overall. What’s more, over one-fifth of Chinese households have purchased a luxury yoghurt. In 2016, the success of Le Pur – a startup that, as its name suggests, aims to offer consumers a pure and delicious yoghurt made from “genuine ingredients” and whose reputation went viral after initial online campaigns – has fuelled a new chapter in high-end, indulgent yoghurts.

A growing number of manufacturers have gone on to launch various kinds of premium yoghurt, in a bid to satisfy both consumers’ high-end yoghurt cravings and their leisure-time snack demands. For example, Mengniu has extended the product line of its popular premium Milk Deluxe and launched Deluxe yoghurt, with the product continuing to use the classic advertising slogan, now expanded to read, “not all yoghurts are called Deluxe”, expecting seamlessly to ally the premium milk brand image with Deluxe yoghurt. Additionally, Guangming, whose main concept is Fresh, expects to fill its high-end yoghurt product line through YoGreek. YoGreek’s brand positioning is novel to the Chinese market, touting its pure, healthy and international credentials: “pure Greek yoghurt, triple the amount of protein, fat-free.”

In conclusion, consumer demands in China are diversifying, meaning that dairy manufacturers not only need to meet growing demand for products, they also need to meet basic health requirements and offer cost-effective products. Consistently improving product quality and communicating honestly with consumers remains an eternal marketing rule for all enterprises.

About the Author

Jason Yu. As General Manager of Kantar Worldpanel Greater China, Jason Yu specialises in consumer panel research and has over 20 years’ experience in serving both manufacturers and retailers in Asia and Europe. He is responsible for strategic development of operations in mainland China and Taiwan, and also sits on the Worldpanel Asia regional board.

Issue

Related topics

Beverages, Flavours & colours, New product development (NPD), Product Development, The consumer, Trade & Economy