Consumers’ attitudes and behaviour driven by risk avoidance in 2020

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 21 April 2020 | Mike Hughes | No comments yet

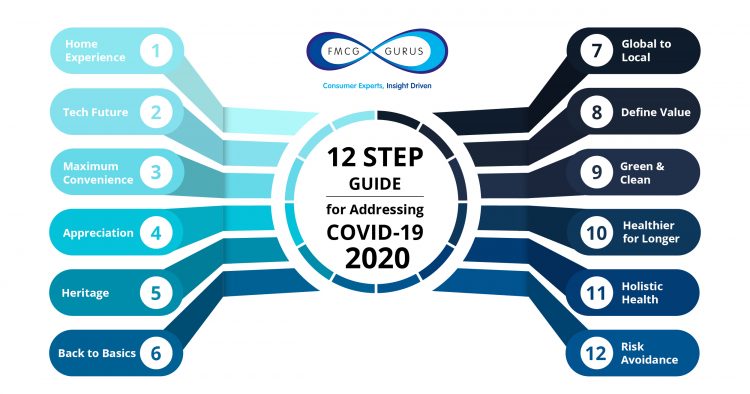

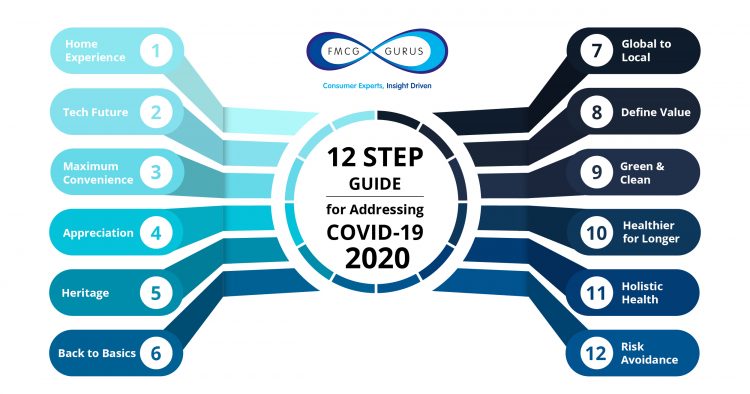

Fast-moving consumer goods (FMCG) have seen a change in demand due to COVID-19 and Mike Hughes, Research and Insights Director at FMCG Gurus, explains why consumers will favour products with low levels of risk in 2020.

COVID-19 is something that will shape consumer attitudes and behaviour considerably over the next 12 months and beyond. One way in which this will occur is through risk avoidance, as consumers look to minimise uncertainty in their life. This is something that will have a profound impact on shopping habits, as consumers look to make budgets go further whilst seeking out trustworthy brands, as well as looking out for products that minimise the risk of illness.

Consumers will look to adjust their shopping habits to make the money go further…

The world is facing a once in a lifetime pandemic that is bringing feelings of concern and uncertainty. Currently, consumers feel unsure about the true impact of COVID-19, when the disease will peak and whether they will be subject to a second wave of the virus later in the year. From a human perspective, this will result in consumers being concerned about their own vulnerability and risk of catching coronavirus, as well as their loved ones.

Additionally, there will also be economic concerns about the impact of COVID-19, with consumers fearing that reduced job security and/or a loss of earnings could occur as a result of a recession. This will impact on consumer behaviour in two major ways. Firstly, consumers will look to adjust their shopping habits to make the money go further and secondly, they will look to improve their health.

An FMCG Gurus shopper survey conducted over the period 2019/2020 found that 70 percent of consumers across the globe say that they adjust their shopping habits when prices are rising, and they are struggling as a result of this. Rather than simply looking for the cheapest product, consumers will instead look to be more resourceful and scrutinise products more closely.

COVID-19 is something that will also result in more consumers questioning their own health and their vulnerability to illness…

When it comes to adjusting shopping habits, consumers are most likely to say that they look to obtain value for money (42 percent) followed by cutting down spend on non-essentials. Whilst consumers may struggle to cut down on non-essentials in reality because of the need for regular moments of escapism, it is apparent that brand loyalty will decline as consumers shop around more. This means it is crucial that consumers feel that brands mirror their attitudes and outlook on life and meet their need states.

Brands need to look for ways to offer reassurance, be it through leveraging perceptions of value and transparency, to offering consumers a convenient way to boost health to addressing wider issues like delivery systems and the impact they have on the environment.

COVID-19 is something that will also result in more consumers questioning their own health and their vulnerability to illness. In 2019, FMCG Gurus conducted an immunity survey across the globe that found 25 percent of consumers believed that they have a poor immune system. Moreover, 53 percent said that they had looked to make changes to their diets and lifestyles in the previous two years to boost their immunity. Again, these attitudes will intensify over the next twelve months and beyond, with consumers seeking out products that contain functional ingredients more regularly. When it comes to such products, affordability will be crucial.

Ultimately, the desire to make finances go further and improve health in order to minimise vulnerability to disease can be linked to the concept of risk avoidance. As such, consumers will increasingly look to turn to brands that they associate with trust, safety and health in 2020 and beyond.

About the author

Mike Hughes has over 13 years’ experience analysing consumer trends, attitudes and behaviours and currently heads up the research and insight division at FMCG Gurus. Mike has a particular interest in highlighting how consumer attitudes and behaviours can often differ and what the true meaning of trends are for the industry.

Related topics

COVID-19, Health & Nutrition, Outbreaks & product recalls, Research & development, The consumer