Global innovation in meat alternatives slows as patent filings fall

Posted: 21 October 2025 | Ben Cornwell | No comments yet

New data shows global patent filings for plant-based and cultivated meat alternatives are falling, following years of rapid growth worldwide.

Global innovation in meat alternatives has slowed, with new patent filings for both plant-based and cultivated meat falling in 2023, according to the latest report from intellectual property firm Appleyard Lees.

In plant-based meats, sales fell by 12 percent and some manufacturers have either reduced operations or gone into administration.”

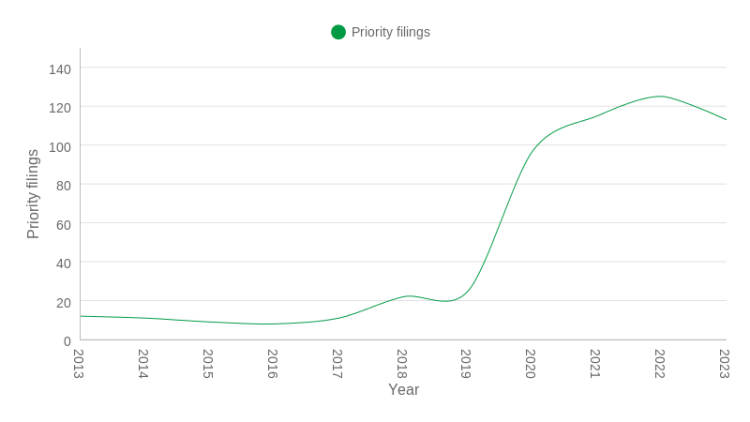

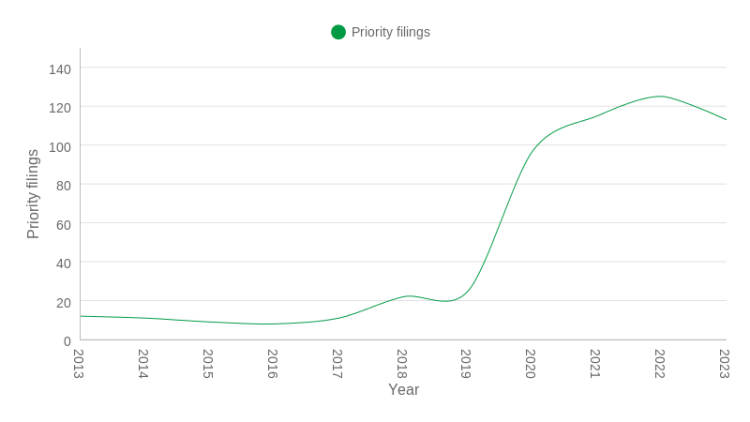

The fifth annual Inside Green Innovation: Progress Report reveals that global patent filings for cultivated meat dropped by almost 10 percent, falling from 125 in 2022 to 113 in 2023. This follows years of rapid growth, including a tripling of filings between 2019 and 2021.

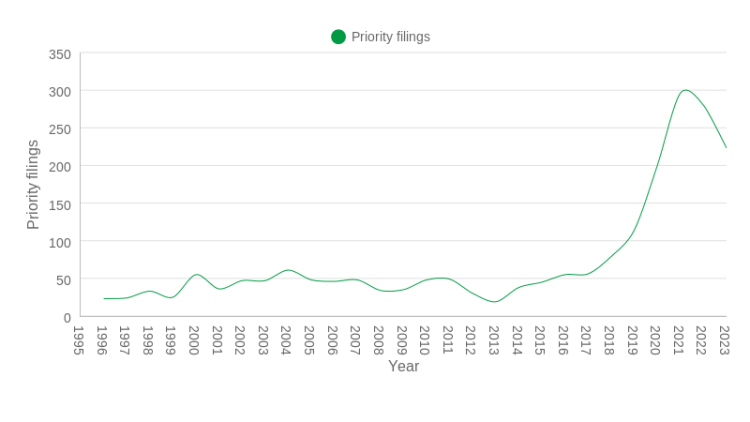

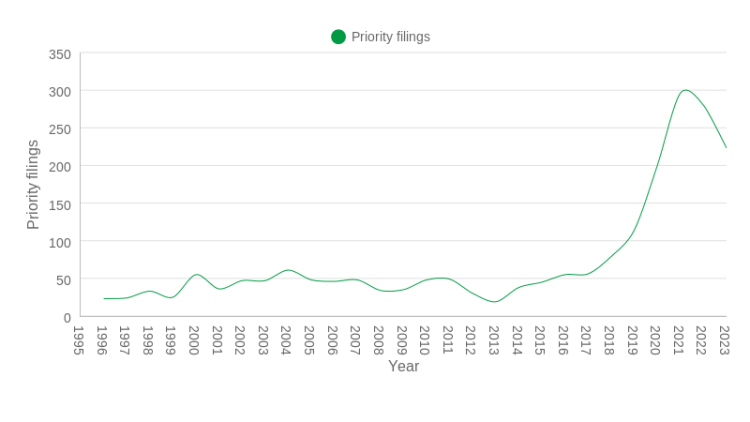

Plant-based meat has also seen a second consecutive annual decline in innovation activity, with patent applications falling 20 percent, from 280 in 2022 to 223 in 2023. The sector reached its peak in 2021 with 296 filings.

Ten-year trend (2013-2023) – global priority filings – cultivated meat innovations. Credit: Appleyard Lees

Global Priority filings 1995 – 2023 – plant-based meat. Credit: Appleyard Lees

“In the cultivated meat sector, funding, regulation and consumer uptake remain key challenges for innovators, alongside up-scaling and production efficiency,” said Emily Bevan-Smith, patent attorney at Appleyard Lees.

James Myatt, partner at the firm, added: “In plant-based meats, sales fell by 12 percent and some manufacturers have either reduced operations or gone into administration.”

Despite the slowdown, companies continue to innovate. For cultivated meat, new patents include technologies to cut production costs, enhance nutritional content, improve fibre structures for better flavour and texture, and use genetically modified cells. In plant-based meat, patents focus on lentil flour, pea and corn proteins, novel soybean formulations, textural improvements and plant-based fish alternatives.

“Global patent activity in the cultivated meat sector shows a strong push to appeal to consumers by creating products that closely resemble conventional meat in flavour, texture, nutritional value and cooking behaviour,” said Myatt. “For plant-based meats, innovations relating to plant-based fish appeared prevalent among many of the top filers.”

Regional trends and most active players

Regional trends in meat alternatives paint a mixed picture. The US saw a 40 percent fall in cultivated meat filings between 2022 and 2023, amid regulatory uncertainty and state-level restrictions, although it remains narrowly ahead of Europe and South Korea. Europe recorded a 25 percent drop, influenced by anti-cultivated meat policies in Italy and France. In contrast, Japan more than doubled its patent activity following government backing and a national industry roadmap.

The US also experienced a 37 percent decline in plant-based meat filings, while Europe led the way with 85 filings in 2023.

Among the most active companies, Dutch firm Meatable BV topped cultivated meat filings, focusing on cell culturing, maturation and fat-enhanced flavour. South Korea’s Hanwha Solutions Corporation also featured strongly, with patents targeting culture media and sensory improvements. In the UK, Ivy Farm Technologies has been advancing bioreactor design, genetically modified cell use and novel culturing methods.

In the plant-based category, multinational food giants Cargill and Unilever remained dominant, driving innovation in protein alternatives and wheat gluten substitutes for minced meat.

The findings suggest that while global innovation in meat alternatives has cooled after years of rapid expansion, the sector’s leading players remain committed to improving quality, efficiency and consumer acceptance.

Related topics

Alternative Proteins, Cultured Meat, Health & Nutrition, Ingredients, New product development (NPD), Plant based, Proteins & alternative proteins, Sustainability, Trade & Economy, World Food