Why are food manufacturers’ margins falling behind?

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 13 March 2024 | Jarrod Adam | No comments yet

Jarrod Adam, Head of Product at Unleashed, unveils challenges affecting manufacturers’ profitability, from overstocking to surging food inflation and evolving supply chains.

By Jarrod Adam, Head of Product at Unleashed

Profit margins appear to have stagnated for UK food manufacturers, despite an overall uptick for the wider manufacturing sector.

New analysis from inventory management software provider Unleashed shows the average food manufacturer made a profit margin of £1.44 for every pound invested in inventory in Q4 2023. That’s the same result as the previous quarter, and a four pence drop from the same period in 2022.

In comparison, the average across all manufacturing sectors in the UK was £2.33 in Q4 2023 – up dramatically from £1.98 in the previous quarter, and £2.05 year on year.

So why are food manufacturers being left behind?

Overstocked – and pressured on price

The short answer is, higher food price inflation; which is well documented as being up to nine percentage points higher than inflation on other goods. While the long answer is: they’re holding too much stock.

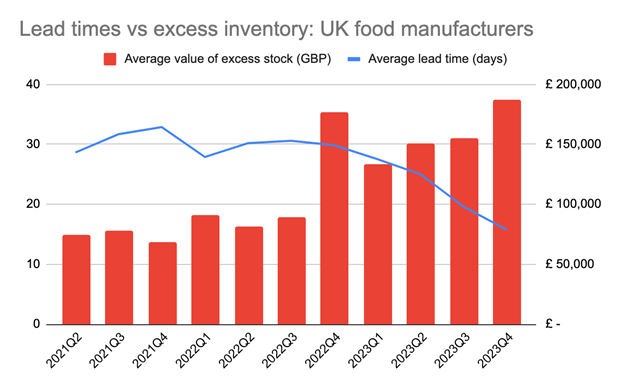

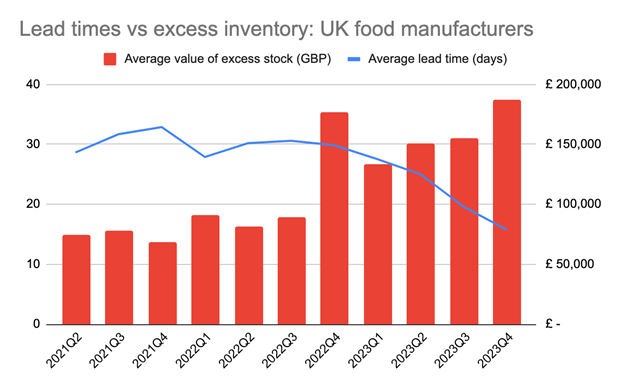

Compared to other sectors, UK food manufacturers haven’t pared back excess inventory levels as lead times have returned to normal.

The data used in the Unleashed software report was pulled directly from the purchasing and inventory systems of over 2,600 SME manufacturers – and measured profitability in terms of GMROI, or Gross Margin Return On Inventory.

It’s a metric that doesn’t directly capture the impacts of things like labour costs – but is very sensitive to a firm’s stockholding strategy. And the approach of the UK food industry to its stock is out of step with the rest of the country.

When lead times drop, warehouse levels must fall too

As the country has slowly exited the supply chain crisis of 2020-2022, lead times – the number of days it takes for goods to arrive once ordered – have steadily fallen back to normal levels: Down from peaks of 42 days in 2021 to just 16 days in Q4 last year.

Naturally, when your raw materials arrive slowly the amount of stock you need to hold in order to tide you over until the next delivery is much higher.

That means you spend far more in order to make each sale – which directly impacts your profitability. And of course the reverse applies when lead times drop. And for manufacturers in the UK, lead times have been dropping fast.

Most sectors have responded by ordering and storing less – allowing them to bank a Christmas windfall. But not so the country’s foodies. The data shows that food manufacturers have done the opposite. A year ago, when lead times were almost double what they are now, food manufacturers drastically upped their inventory levels. And they’ve since kept them high, even as supply chain conditions eased.

Was that unwise – or simply necessary?

In the face of rising prices and longer-term contracts food makers may have opted for security of supply – and price certainty – over cost efficiency.

For many that will have been a necessary evil in the face of the Russia/Brexit/COVID 19 supply chain storm. But now, with very slim margins to work with, the nation’s food industry planners and purchasers will be eyeing their bulging warehouses closely and wondering if they dare slim down their stock.

Their continued profitability may well depend on it – as well as on the level of visibility those decision-makers have. But as the Red Sea crisis now adds to the long list of supply chain shocks affecting food manufacturers, the task of coaxing healthier financials from a pressured situation will need to be done with care.

About the author

Related topics

Recruitment & workforce, retail, Supply chain, Trade & Economy