Identifying consumer preference segments in NPD

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 18 December 2017 | Alex Baverstock, Jinho Cho, Josef Zach | No comments yet

Alex Baverstock, JinHo Cho and Josef Zach from Ipsos explain Sensory Spatial Segmentation (SSS), their novel technique for analysing consumer preferences.

ON THE SCENT: understanding how a product delivers against different consumer preferences is critical for understanding appeal and ultimately sales success

Identifying consumer preference segments in product development research is valuable to R&D and marketing functions. It is well known that products are not universally liked. For example, some people like a sweeter soft drink while others prefer a less sweet or aromatic flavour profile; some people like a skin cream to be smooth and quickly absorbed while others are more concerned by its fragrance. Whatever the product, understanding how it delivers against different consumer preferences is critical for understanding appeal and ultimately sales success.

The research methodology for identifying and understanding possible preference segments within a category is based on the combination of sensory profiling data (usually objective product descriptions from a trained sensory panel) and consumer liking data (based on product trial). The ability to identify different preference segments is contingent on testing a wide variety of products to represent the key sensorial attributes (eg, flavour, texture, fragrance). The total number of products required for these exercises is therefore usually high; a minimum of seven is advised and it can sometimes be as high as 16.

Traditionally, segmentations are developed using a cluster analysis, which requires consumers to test all the products (ie, a ‘multi-day complete design’). With too many products to test in one sitting, this usually means consumers having to come to a central location over several consecutive days to provide their feedback on all products.

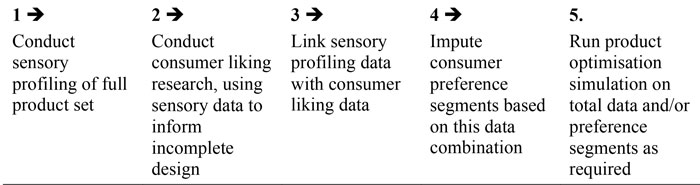

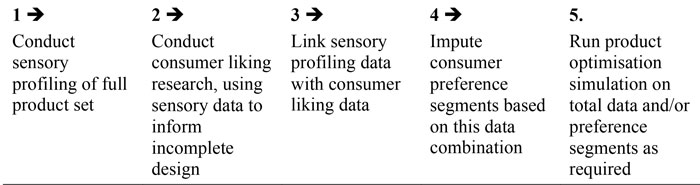

The challenge to produce a reliable and meaningful consumer preference segmentation solution in a less time-consuming and more cost-efficient manner was the driving force behind the development of a new approach that we call Sensory Spatial Segmentation (SSS) (Figure 1). In exploring this new approach, we also learned that multi-day complete designs are not always necessary for the best understanding of consumer preferences. Our findings show that an incomplete design often provides better discrimination and stronger segmentation solutions, with the added benefits of significantly reduced study time and investment.

Fig. 1: Outline of basic project steps in a consumer preference segmentation using SSS

SSS uses the combination of sensory profiling data and consumer liking data. The sensory profiling data is based on the full range of products in the test, but the consumer liking data can be from either a complete or incomplete design. The steps in the research are outlined below.

The Sensory Spatial Segmentation approach

We used the Sensory Spatial Segmentation approach on 15 different multi-day consumer preference studies across multiple product categories and geographies. In these tests we applied the SSS approach to both the complete consumer liking data set and that derived from only the first day consumer scores (ie, we used a random incomplete design).

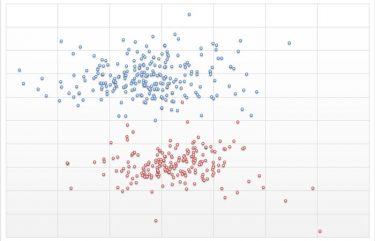

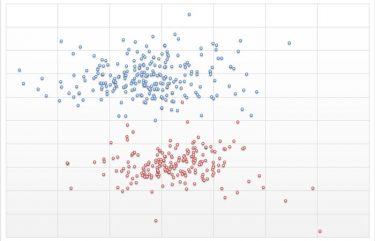

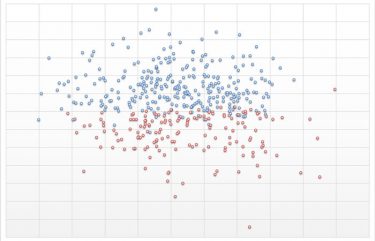

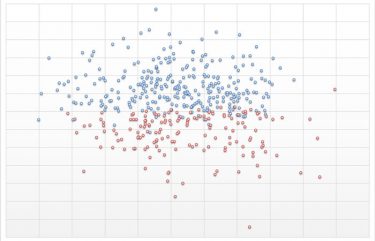

In doing this, we confirmed that the segmentation solutions from SSS based on the incomplete data set were stable and reliable. In addition, this validation also showed that the segmentation solutions from the first day consumer results were generally more discriminating than those based on the total data set (Figure 2).

Fig. 2A: Consumers’ position in the sensory space after day one

Fig. 2B: Consumers’ position in the sensory space after day three

[Figs. 2A and 2B are Illustration of how the same segmentation solution from SSS discriminates between consumers based on their responses on the first day of testing (ie, replicating a random incomplete design) and on the third day of testing. In the final day, consumer liking data has lower variance and the preference segments are significantly less well defined.]

Why? Because on the first day of testing consumers react more strongly to products they like and dislike, and they better discriminate between products on the first day as compared to the second and third days of testing. This makes good sense. In tests such as these, consumers are exposed to a much wider range of products than they normally handle in their daily lives. Consequently, their preferences may adapt to a higher tolerance for products that were originally less liked (ie, they get used to them), or a lower tolerance for products they originally preferred (ie, too much of a good thing).

The result is that liking data captured in second and subsequent days of testing becomes less representative of consumers’ true reactions. If this is the case, then why should we default to these multi-day complete designs? By reducing the interview burden for each consumer, and reducing the costs of fieldwork and sample production / procurement, the total project investment can be reduced by as much as 50 per cent.

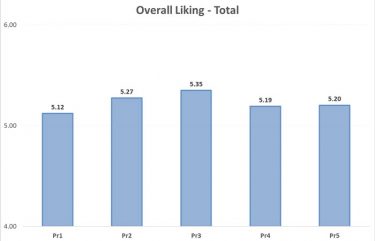

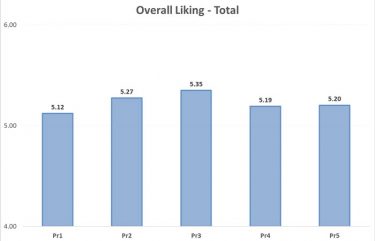

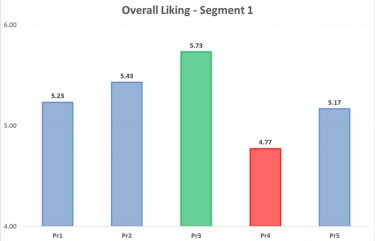

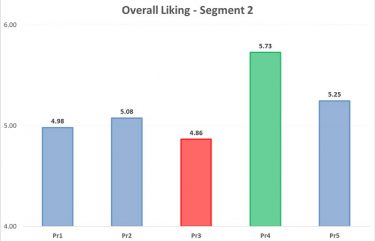

We used the Sensory Spatial Segmentation approach with L’Oréal, who wanted to identify the sensory drivers of consumer liking for a personal care product. The research helped L’Oréal to identify two distinct preference groups with opposite desires as to the sensory properties of five different products, when currently there is only one product type in the market (Figure 3). These findings have led to a new business opportunity for L’Oréal – introducing a new product to the market.

The food market is the number one area to leverage the new Sensory Spatial Segmentation approach. Within the food area, multi-product tests are mainly conducted as Central Location Tests. With Sensory Spatial Segmentation, these Central Location Tests can be conducted so that consumers have to attend only one session. This presents a true cost-saving opportunity for food companies with limited resources, who are now able to understand the drivers of liking as well as potential consumer groups with different liking patterns, without making any compromises to the data quality.

Sensory wise, the five products differed in many attributes. For the total population, no significant difference was found between the five prototypes. After applying SSS segmentation, two distinct preference groups were found.

About the authors

Issue

Related topics

Flavours & colours, Ingredients, Research & development, Sensory technology, The consumer