The meat industry: what’s the beef?

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 19 August 2020 | Nick Allen | No comments yet

Nick Allen, CEO of BMPA, highlights a big challenge within the meat industry and asks: Who’s really paying the price for low cost mince?

Beef mince is one of the staple foods in the British diet. It is plentiful, economical and easy to cook… but the current crisis has exposed a problem with mince that has been growing over the past 15 years.

Such is the challenge that, at the height of the crisis, Defra convened a special Beef Forum group as part of its Agriculture food chain engagement work to tackle this issue.

This new forum will hopefully continue and enable parties up and down the food supply chain to conduct an open and constructive debate in order to find a fair solution that works for everyone.

The problem

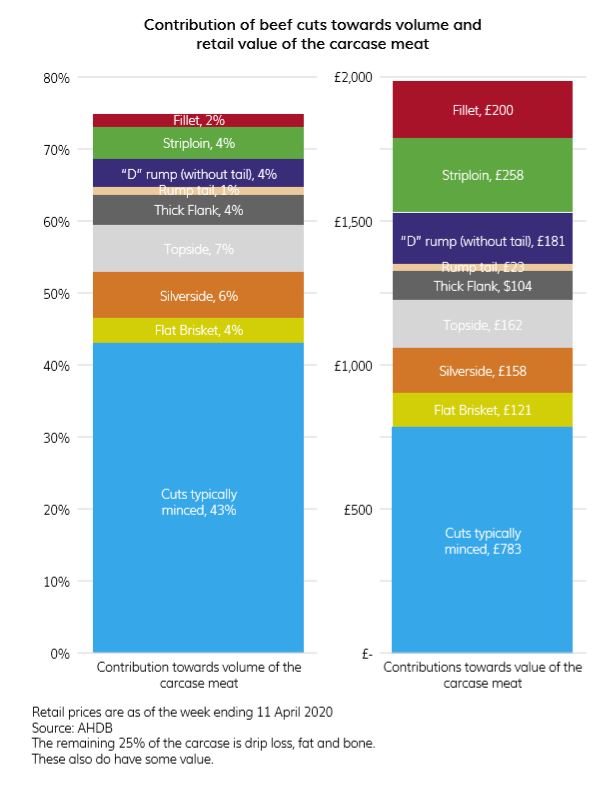

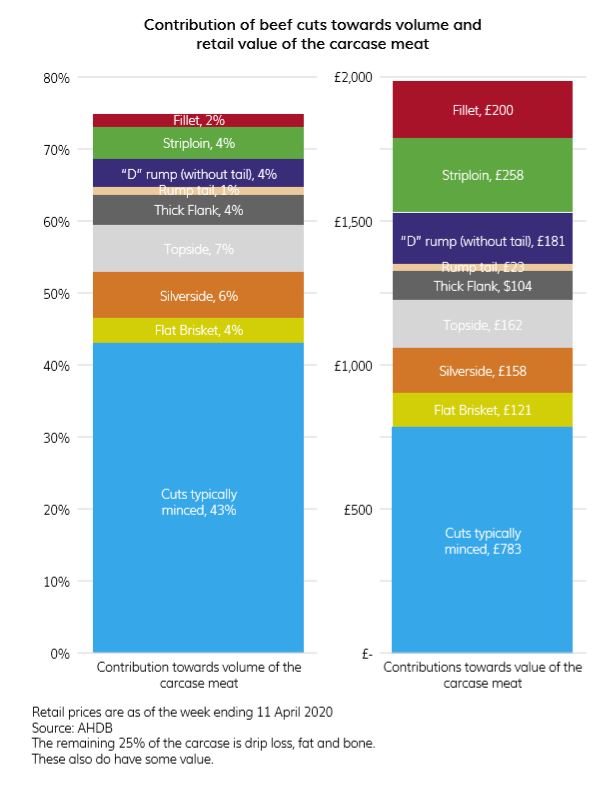

The problem is best explained by reviewing how carcase balance is supposed to work. The main types of fresh beef purchased in the UK are roasts, steaks and mince, and because mince is seen as an affordable staple, retailers want to be able to sell it at the lowest price they can as part of their ‘everyday low-price’ strategies.

To achieve this, meat processors sell mince to retailers at, or even below, cost. To balance this out, processors are able to achieve higher profit margins on roasts and steaks, and it is those higher margins, along with the sale of other parts of the carcase (such as skins, hides and bones) that compensate for the lack of profit on mince.

However, the percentage of beef meat going into mince has been steadily increasing over the years, rising from approximately 45 percent in 2005 to over 60 percent today.

Moreover, the spike in demand for mince during the COVID-19 crisis – from an average 55 percent to over 70 percent of all primary beef sold by retailers – coupled with a huge drop-off in orders from the out-of-home food service sector, has broken the pricing model entirely.

The graph (Figure 1) illustrates perfectly how a small increase in the amount of a carcase that is minced can have a big effect on profitability.

That temporary squeeze in supply has since corrected and, for now, supermarket ordering has returned to a more commonsense, hands-on system of human intervention.

However, not all meat processing companies are able to simply divert capacity to increase supply to the supermarkets.

Suppliers to the food service industry generally produce bulk packs. They do not have the packaging and machinery to produce the kind of vacuum and modified atmosphere product with the requisite nutrition labelling that the retail trade requires.

The pressure has therefore been on the remaining food processing plants that are set up for this. These retail suppliers have been working at full capacity to meet this unprecedented demand for mince and cheaper cuts.

Of pressing concern is the need to keep the movement of goods across borders both in the EU and further afield.

However, there was a large build-up of meat that was destined for the food service sector that cannot be sold to supermarkets, and much of this has either had to be sold at hugely discounted prices to the wholesale market or has been frozen and correspondingly devalued. This is partly because it is not packaged and labelled for the retail market, but mainly because there just is not the retail demand to replace the food service market.

To make matters worse, cold store capacities were almost full, which meant in the absence of another market for this product, processors started reducing the number of animals they buy.

This can cause potential issues that could seriously impact both farming and meat processing operations.

With processors unable to sell all parts of the carcase at the right price, it is becoming unprofitable to continue processing, unless, that is, the price of livestock is reduced. In this scenario, the problem will end up at the farm gate, with farmers struggling to sell their animals at a price that covers their costs.

It is worth noting that, by the time this article goes to press, a similar carcase balance problem will be starting to play out in the sheep sector as the spring lambs that are already in the fields start to come to market.

Of pressing concern is the need to keep the movement of goods across borders both in the EU and further afield. Carcase balance also depends on the ability of British processors to sell into overseas markets where there is better demand for the products that UK consumers do not favour and also for by-products like skins and hides.

However, these products are become harder to shift because all our regular trading partners are having the same problem. A stark illustration is the hollowing out of the hides market. Whereas processors were achieving £28 per hide a year ago, they are now, in some instances, having to pay around £7.50 to have them taken away.

Regardless of these short-term imbalances caused by the COVID-19 crisis, we still have the issue that consumer buying habits have been changing over the longer term. It therefore makes sense that the pricing model should also evolve to ensure better resilience across the whole supply chain for producers, processors and retailers. In order to achieve this, any new pricing model will rely on processors getting a fair price for all parts of the cow, from steaks, roasts and mince, through to hides and bones.

How can we fix the broken pricing model?

One solution to this issue is to have some convergence between the price of mince and the price of top cuts. If retailers were to buy mince at a fair market value but be able to buy other cuts slightly cheaper than they do currently, they would have the flexibility to set their prices to customers in several ways.

They could lower the price of top cuts and slightly increase the price of already cheap mince which, according to research, would have little effect on the amount of mince people buy.

The percentage of beef meat going into mince has been steadily increasing over the years, rising from approximately 45 percent in 2005 to over 60 percent today.

Alternatively, they could keep mince at the current price and continue to sell other cuts at the price they are now, but with a bigger margin. Either way, retailers would have the opportunity to continue supplying a range of meat at different price points with little impact on their bottom line. Crucially, this new pricing model would provide the resilience that is currently lacking.

Farmers could continue to farm sustainably, processors could continue to operate sustainably, and the public could continue to enjoy a good selection of quality British meat at fair prices.

Retailers naturally want to compete on price, but when that price competition means that suppliers are being forced to sell their products at or below cost, then something is very wrong. It suggests that a fundamental flaw exists in the current food supply chain; one that is unsustainable. This is something any government should take notice of because, ultimately, our food security depends on it.

About the author

Nick Allen has a deep understanding of the British meat and livestock industries, having previously worked in market development roles for the Meat and Livestock Commission, AHDB, and the English Beef and Lamb Executive (EBLEX). As CEO of the British Meat Processors Association (BMPA), he is able to pull together his connections from across farming, the meat industry, retail and government to forge a more collaborative approach to the UK’s food challenges. As well as his role with BMPA, Nick also runs a farm in Hampshire.