Business booming for the global food grade lubricants market

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 4 February 2019 | Mayank Sharma | 1 comment

Mayank Sharma offers an overview of the global food grade lubricant market, points out recent developments and highlights key factors that will impact its future growth.

Food grade lubricants refer to a group of industrial lubricants used to minimise the wear and tear of industrial machinery caused by issues such as corrosion, friction, and oxidation. In some extreme cases these lubricants can also prevent or reduce electrical resistivity, while increasing thermal conductivity. They are widely used in the food & beverage and pharmaceutical industries, primarily because they don’t present any physiological threat or affect the odour and taste of the finished products.

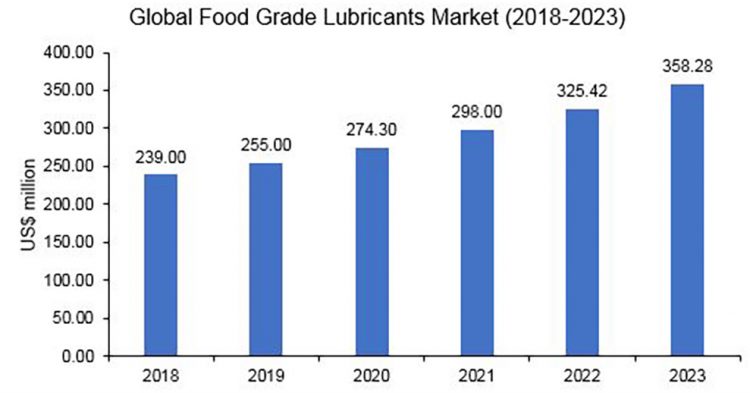

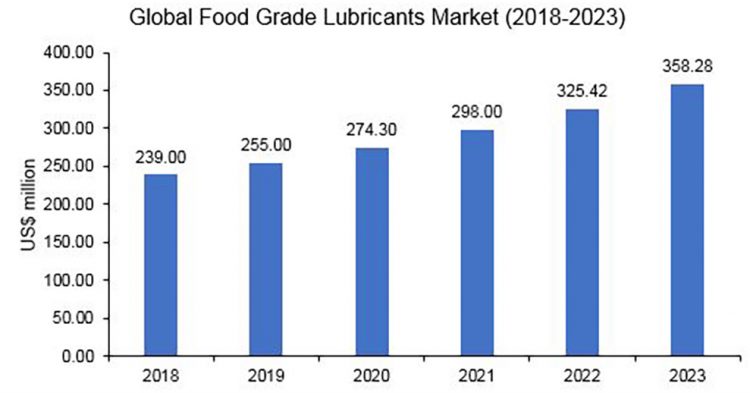

The global food grade lubricants market (Figure 1) is highly competitive and in 2018 was valued at US$239 million with expectations to grow at a CAGR of 8.43 percent in the period 2018–2023 to reach US$358.28 million. The increasing consumption of food products such as oilseed, meat, dairy, and beer will increase the use of food and beverage processing machinery to further drive the food grade lubricants market.

According to the United States Department of Agriculture (USDA), food grade lubricants are divided into the following three categories:

- H1 lubricants are used in food processing units where there is a high possibility of direct contact with the food material. These lubricants are made of one or more base stocks, additives, and thickeners as listed in the USFDA’s regulations 21 CFR 178.3750. These lubricants are used in food and drink processing industries.

- H2 lubricants are used in equipment and machine parts where there is no possibility of the lubricant or lubricated surface coming into contact with the food material. These lubricants do not contain harmful materials such as antimony, arsenic, lead, cadmium, mercury, selenium, carcinogens, teratogens, mutagens, and mineral acids.

- H3 lubricants are used in trolleys, hooks, and similar equipment. These lubricants are soluble in edible oil and are generally used to clean and prevent the formation of rust.

Food grade lubricants can be categorised depending on their base ingredients as mineral or synthetic-based lubricants. Mineral oil lubricants are extracted from crude oil and consist mainly of hydrogen and carbon. They are the most widely used lubricants across the globe as they are more affordable and easily available than synthetic oils. Mineral-based food grade lubricants are highly refined, tasteless, colourless, odourless, and non-staining in nature. Synthetic lubricant oils, however, are set to experience a higher growth rate because of their availability and cost advantages over mineral-based lubricants.

Figure 1

In 2018, mineral-based lubricants dominated the global market with a share of approximately 77 percent, but is expected to decline to approximately 75 percent by 2023. Synthetic lubricant oils are more efficient than their mineral-based counterparts under extreme pressure and temperature conditions as they can be adapted to a wide range of viscosities, resulting in higher oxidation stability. Synthetic oil lubricants increase the performance and sustainability of equipment and play a vital role in maintaining a low production cost throughout the equipment lifecycle.

Food grade lubricants market developments

It has been a busy time for food grade lubricant manufacturers. Some of the recent product launches of key vendors are listed below:

- In September 2017, Klüber Lubrication launched Klüberfood NH1 74-401, which is a synthetic high-temperature grease that is effective at permanent temperatures up to 160oC

- In September 2017, Klüber Lubrication launched Klüberplus C2 series consisting of C2 K2 Ultra Dry, C2 PM2 Super Dry, and C2 PM2 Ultra Dry for the lubrication of plastic conveyor belts. For instance, C2 K2 Ultra Dry is used to lubricate conveyor belts transporting carton beverage packages.

- In June 2016, Petro-Canada Lubricants launched Purity FG lubricants formulated with SynFX, which is an advanced additive technology.

Leading companies are focusing on launching effective products and entering into joint ventures, memorandums of understanding, or acquisitions to gain a competitive edge in the industry. For instance:

Ø In 2018, Fuchs petrolub group acquired the lubricants business of Commercial Pacific Ltda. in Chile

Ø In 2017, HollyFrontier Corporation acquired Petro-Canada Lubricants, which produces automotive, industrial and food grade lubricants and greases.

The Americas dominated the global food grade lubricants market in 2018, accounting for around 36 percent of the market, and it is expected to grow at a CAGR of some 8.7 percent during 2018–2023 to reach approximately US$130 million. The implementation of food safety regulations in the US is expected to drive this demand for food grade lubricants.

The food grade lubricants market in APAC was valued at around US$83 million in 2018 and is expected to grow at a of CAGR of around 8.9 percent during 2018–2023 to reach around US$127 million. The increasing demand for dairy products, packaged foods, meat products, and pharmaceutical products in countries such as China, India, and Australia is expected to be a significant driver of the food grade lubricant market in APAC.

The food grade lubricants market in EMEA accounted for around US$71 million in 2018 and is expected to grow at a CAGR of around 7.5 percent during 2018–2023 to reach around US$102 million. The growth of the food grade lubricants market in this region is attributed to the growing incidents of food-borne infections such as those caused by EHEC (Enterohemorrhagic Escherichia coli) in countries like France and Germany. There are no stringent regulations in the European Union regarding the usage of food grade lubricants; however, organisations such as the EHEDG (a consortium of food industries, equipment manufacturers, research institutes, and public health authorities) have developed guidelines on the usage of food grade lubricants, which have been outlined in previous editions of New Food.

Growth drivers

Some major factors that will drive the growth of the food grade lubricants market are as follows:

- Stringent rules and regulations prohibiting the use of non-food grade lubricants due to growing concerns about health and safety in the food industry. For instance, in the US, the ingredients of food grade lubricants must be formulated in accordance with Title 21Code of Federal Regulations (21CFR) 178.3570, which states the acceptable ingredients – such as oils, antioxidants, surfactants, etc – to be used in the manufacturing of food grade lubricants, along with use limitations.

- The demand for packaged and convenience foods is increasing in developing countries due to changing lifestyles, rapid urbanisation, and lack of time. This scenario is expected to have a positive effect on the food grade lubricants market, as the canned food market is the major user of these lubricants. The global canned food market was valued at ~US$98 billion in 2018 and is expected to grow at a CAGR of ~3.8 percent during 2018–2023 to reach ~US$118 billion.

- Food security is becoming a major global concern due to the ever-increasing population; the world population was 7.6 billion in 2017 and is expected to reach 8.6 billion by 2030. The demand for food is also expected to increase by 100 percent by 2025, including a projected 16 percent increase in global meat consumption by 2025. The global demand for meat processing machinery is driven by the growing food safety concerns and increased consumption of processed foods, including protein-rich meat products. The market is expected to grow at a CAGR of ~6.8 percent during 2018–2025; therefore, the demand for food grade lubricants for machinery equipment used in meat processing is also expected to increase.

Future challenges

Some of the key issues that the food grade lubricants sector is likely to experience over the next few years include the following

- The carbonated beverage industry is witnessing a slow growth rate due to stringent government policies and regular checks on manufacturers due to various contamination issues. The growing awareness of health risks associated with the consumption of carbonated drinks has shifted the consumers’ preference to flavoured water, juices, and other healthy products.

- Consumers are reducing their consumption of processed meat in the US as research has suggested that excessive consumption may lead to severe health issues. For instance, the World Health Organization has identified that processed meat may be a contributor to colorectal cancer. Also, it is hard to maintain the potassium/sodium ratio in processed meat, as it is available pre-cooked or with the potassium-rich moisture removed, which tends to remove the potassium content. Additives such as nitrates and nitrites –poisonous preservatives used to kill bacteria and other pathogens – are also used to impart a pink colour to processed meats and to increase their shelf life. These additives are said to negatively affect kidney and liver function in those individuals who consume such products. Thus, the health risks associated with the consumption of processed meat is a major challenge to the meat processing machinery market and is expected to negatively impact the global food grade lubricants market as well.

Some final reflections…

Food grade lubricants play a dual role: not only do they protect machine parts, but they also prevent health hazards in case of incidental contact with food products. Even given all these advantages of food grade lubricants, lack of awareness hinders the adoption of food grade lubricants in certain developing regions. The message for any serious, reputable food company is clear, however: food grade lubricants are an essential part of best practice.

About the author

Mayank Sharma serves as an analyst at Infiniti Research Pvt Ltd. He holds an MBA degree in Business Analytics and Marketing from University of Hyderabad. He is from Shimla, Himachal Pradesh, India.

Issue

Related topics

Contaminants, Fats & oils, Food Grade Lubricants, Food Safety, Trade & Economy

Great article! Can you kindly share the sources of your data?