Playing it safe in mergers & acquisitions

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 5 February 2019 | Quincy Lissaur (SSAFE) | No comments yet

Failure to anticipate the food safety risks that can arise when acquiring companies – especially less mature ones – has led to production stoppages, product downgrades, dramatically higher costs, and severe reputational damage. Quincy Lissaur of not-forprofi t organisation SSAFE explains why food safety should never be an afterthought for anyone taking on a food business.

2017 WAS ANOTHER record year for global food and drink industry acquisitions. Transactions averaged almost 14 a week; 40 percent more than five years ago. In fact, apart from a dip in 2013, they’ve been increasing every year since 2012. As food companies try to keep up with rapid changing consumer tastes and demands, acquisitions have become a core part of growth and innovation strategies for many food businesses. For some acquiring companies, however, a healthy appetite for consolidation and growth has resulted in a nasty dose of heartburn. Failure to anticipate the food safety risks that can arise, especially when buying less mature companies, has led to production stoppages, product downgrades, dramatically higher infrastructure and other costs, and severe reputational damage. Furthermore, as bigger brands continue to gobble up the smaller players now proliferating across the industry, these risks can increase significantly.

Guide for food safety in acquisitions

That’s why SSAFE, a non-profit organisation founded to address the challenges faced by supplying and trading safe food around the world, worked with its members and Accenture to develop an Industry Best Practice Guide on how to manage food safety during the due diligence and post-merger integration (PMI) phases of M&A activities across the food industry. Available for free download from the SSAFE website, the guide is applicable to all types of food businesses, irrespective of geographic location or company size, and is flexible to enable the user to tailor its application to its own unique acquisition situation. It also comes with a handy checklist for users to apply as they see fit to their M&A activities.

“The intention of the SSAFE guide is to help the food industry improve how it conducts due diligence and post-merger integration activities. Applying the knowledge, experience and expertise from SSAFE members and Accenture can help businesses reduce potential food safety issues going forward.“

Neil Marshall, President of SSAFE

The robust approach to food safety in both due diligence and post-merger integration activities set out in the guide is expected to help deliver significantly better outcomes. Since most food companies devote less than two percent of their due diligence efforts to food safety issues during M&A activities, as suggested by research conducted by our partner Accenture, it is vital that there is a consistent and common method for the industry to look at all aspects of food safety as part of a merger or acquisition. We believe this guide provides such a method.

Due diligence

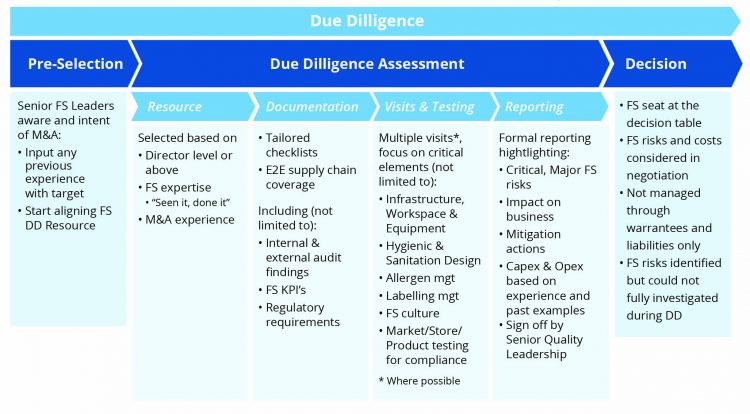

When assessing a new acquisition, companies usually go through a three stage process: pre-selection, due diligence assessment, and decision. The pre-selection phase is primarily a financial and commercial assessment to determine whether the target is attractive. The due diligence assessment is where, as part of a broader M&A team, a food safety expert should be involved to determine the maturity of food safety practices at the target company and how this may impact the purchase. The higher the risk of food safety failures identified during this phase, the bigger the potential financial impact could be after the acquisition is made. Finally, a decision is made based on all available information sourced. Figure 1, taken from the guide, shows a simple process flow of food safety due diligence activities.

Figure 1: Overall process flow for food safety due diligence

The quality of a company’s due diligence depends on the maturity of its due diligence activities. The more mature the company’s food safety due diligence activities, the more likely it is that it will have a true and fair picture of the risks associated with the acquisition.

The guide provides a maturity matrix to help companies determine how advanced they are in their food safety due diligence activities and provides guidance on how to strengthen and improve that maturity from a set of basic to a series of advanced activities. In addition, the guide lists eight key success factors to give the reader specific tips on how to improve their due diligence based on the knowledge and experience of our members.

Post-merger integration

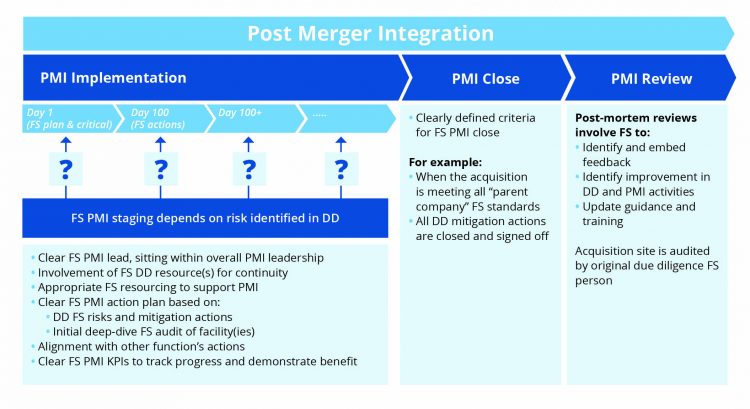

No M&A guide would be complete without looking at how to integrate the two companies’ food safety activities if the acquisition is successful (Figure 2). Simply imposing the buying company’s food safety systems and practices onto the acquired company is not an eff ective means of conducting the integration. Rather, it is important to develop a post-merger integration plan; set up a team with food safety experts from both companies; set key performance indicators to address any risks identifi ed during the due diligence; and close everything out over a predetermined period of time.

Figure 2: Overall process flow for food safety post-merger integration

Although M&A activity may slow down somewhat over the next 18-24 months, as many food companies work on integrating recent acquisitions into their businesses, M&A will not go away. Ensuring that a company addresses food safety as part of its M&A activities is vital for continuous improvement, the strengthening of food safety, reducing recalls and outbreaks of foodborne illnesses, and ultimately ensuring the acquisitions made are a commercial success – both in the short and long term. It is the aim and desire of SSAFE that this guide will help deliver that.

References

1. https://www.zenithglobal.com/articles/2172

About the author

QUINCY LISSAUR has been the Executive Director of SSAFE since 2013. Having graduated with a degree in entrepreneurship from Babson College in 1999, Quincy has worked as a management consultant throughout his career, which included eight years working on food safety and sustainability standards at the British Standards Institution. He is a Dutch national with extensive international experience, having lived in the Netherlands, Brazil, USA, Venezuela, the United Kingdom and France. He currently resides in Colombia.

Issue

Related topics

Food Safety, Processing, Quality analysis & quality control (QA/QC), Trade & Economy