GLP-1 supplements for weight management: what Vitafoods Europe 2025 taught us

Posted: 19 June 2025 | Ian Westcott | No comments yet

Glucagon-like peptide-1 (GLP-1) supplements stole the spotlight at Vitafoods Europe 2025 in vibrant Barcelona (20-22 May). The undeniable impact of GLP-1 agonists on global health and nutrition left no seat unclaimed, as the only appetite left unsuppressed was for clarity on how the drug will shape the nutraceuticals industry.

Vitafoods Europe 2025 in Barcelona reflected the surging consumer interest in the future of GLP-1 supplements.

For decades, pharmaceuticals and dietary supplements have been seen as separate, often conflicting, worlds. Pharmaceuticals are tightly regulated and focus on treating disease, while supplements operate in a looser regulatory space aiming to support wellness and nutrition.

But the GLP-1 revolution is breaking down these barriers. With half of the world’s population projected to be overweight by 2035, the urgency of effective weight management solutions has never been more apparent. Pharmaceutical breakthroughs like Ozempic, Wegovy and Mounjaro have revolutionised the conversation, offering what many see as heroic interventions. Yet their rise has paradoxically opened an exciting new frontier for the nutraceutical industry too.

The landscape of weight management has fundamentally changed — and it’s not going back.”

– Jennifer Cooper, President, Enova

During the panel discussion The future of weight management: Navigating the Ozempic era, Bill Giebler, Content & Insights Director at Nutrition Business Journal, was asked how the rising demand for GLP-1s is affecting the conventional weight loss market. He explained, “I think what we’re seeing is the opposite. The activity around GLP-1 agonist drugs is boosting interest in supplement products that have a similar effect, but more so in products that have a complementary mechanism of action.”

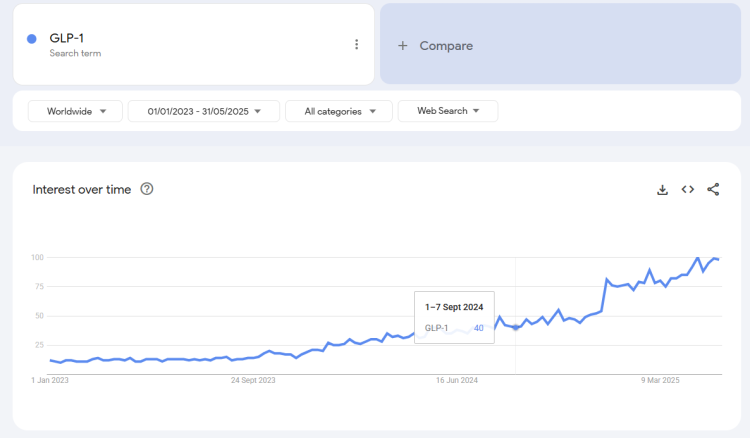

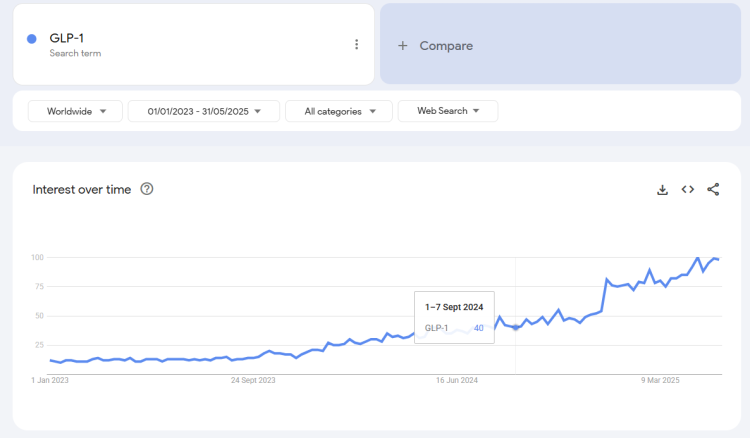

Vitafoods Europe vividly illustrated this growing momentum in the nutraceutical sector, especially around GLP-1 Nutrition. During her presentation, Rousselot’s Florencia Moreno Torres presented Google Trends data showing an exponential rise in consumer interest since 2023 – a trend not limited to the US but also evident in China, Puerto Rico, Denmark and South Korea. Supporting this, Anova’s database revealed that product launches with ‘GLP-1’ on the label soared from fewer than 100 in 2023 to over 3,000 in 2024. Rousselot’s own survey data echoed these findings, highlighting a significant uptick in consumer interest in GLP-1-boosting and blood-sugar control supplements. This confluence of data points to a remarkable, global shift in the market landscape.

Understanding GLP-1 and GLP-1 RAs

It is important to distinguish between GLP-1 and GLP-1 RAs. GLP-1 (glucagon-like peptide-1) is a naturally occurring gut hormone released in response to food intake. It plays a critical role in regulating blood sugar levels, promoting feelings of satiety and slowing gastric emptying. In contrast, GLP-1 receptor agonists (GLP-1 RAs) are synthetic pharmaceutical drugs that mimic and amplify the effects of GLP-1 by binding to the same receptor. If GLP-1 RAs can be considered the ‘nuclear option’ delivering a powerful and rapid intervention, then natural GLP-1 stimulation represents a more measured supportive approach that is less aggressive but still crucial for long-term wellness and metabolic balance.

As Jennifer Cooper, President of Enova, noted regarding the drugs’ impact, “it really is unprecedented” in terms of percentage body weight changes observed. And as Bill Giebler succinctly put it, “there’s not likely to be a supplement that even touches that level of effectiveness.”

This distinction highlights two clear avenues for nutraceutical innovation: stimulating the body’s natural production of GLP-1 through diet and supplements and supporting individuals taking GLP-1 RAs by addressing potential side effects and nutritional deficiencies.

Search demand for “GLP-1” more than doubled between January 2023 and May 2025, highlighting its emergence as a dominant theme in wellness and weight management.

Addressing the GLP-1 journey: nutritional needs and side effect mitigation

A feature of the ‘Ozempic era’ panel was the nuanced understanding of the ‘GLP-1 journey’ itself, particularly the emerging needs that nutraceuticals are uniquely positioned to address. Mariette Abrahams, CEO & Founder of Qina, delivered a surprising observation: the biggest and fastest-growing opportunity for the supplement industry lies with the population “coming off the drug.” She cited high discontinuation rates – around 70 percent still taking the drug by month three, dropping to about 40 percent by month six, often due to factors like cost or medical advice – creating a vast demographic seeking support to maintain progress and manage lingering effects.

Consumers aren’t just looking for natural Ozempic — they’re looking for long-term support.”

– Panel insight from Vitafoods Europe 2025

Beyond discontinuation, current users face the challenge of muscle loss. Jennifer Cooper raised the point that while GLP-1 drugs achieve impressive weight reduction, a substantial portion (estimated at 20-30 percent) can come from lean muscle mass. This concern was widely echoed by consumer data, with a significant percentage of respondents expressing worry about muscle building. This creates a clear and immediate demand for high-protein formulations, amino acid supplements and creatine to preserve vital lean mass.

Furthermore, the reduced food intake inherent to GLP-1 therapy, while effective for weight loss, can inadvertently lead to nutrient deficiencies. Specific concerns around Vitamin B12, iron and Vitamin D were raised. As Cooper stressed, “supplementation has a really important role for filling those gaps,” and it is far easier to prevent these deficiencies than to manage them once they become severe. This proactive approach, she suggested, could significantly improve the user’s experience and prevent common reasons for discontinuation, such as extreme nausea.

Indeed, digestive discomfort was another frequently cited side effect. The gastric slowing mechanism of GLP-1 drugs, while beneficial for satiety, can also contribute to nutrient malabsorption and discomfort. This points to a clear need for supplements that support gut health.

Tackling ‘Ozempic face’ and hair loss

Cosmetic side effects of GLP-1 RA use were addressed across multiple panels, from drawn facial features to thinning hair. Entering the public consciousness via swathes of social media commentary, ‘Ozempic face’ is a term that describes the hollowed appearance that can be triggered by rapid loss of subcutaneous fat. These concerns were reinforced by consumer surveys, with a notable percentage worried about changes to their skin and face. As Bill Giebler aptly reflected, “what the consumer notices isn’t the lean muscle wasting, it’s their hair falling out.” These issues, while perhaps not life-threatening, significantly impact quality of life and create a distinct niche for ‘beauty-from-within’ products.

The nutraceutical industry is actively developing solutions for these aesthetic concerns, with innovations spanning ingredients like collagen peptides, hyaluronic acid, biotin, specific vitamins and minerals, and various botanical extracts targeting skin elasticity, hydration and hair health.

Spotlight on ingredients and formulations

Solutions addressing the distinct needs of the GLP-1 era, as discussed at Vitafoods, were prominent throughout the exhibition.

For those looking to influence the body’s own GLP-1 production and better manage glucose, innovations in specific collagen peptides were highlighted. For example, Rousselot’s Next GC, a specialised composition, was presented with clinical study data demonstrating its ability to significantly reduce glucose peaks (by an average of 42 percent) and boost natural GLP-1 secretion. Presenters emphasised such supplements stimulate the body’s own gentle mechanisms, distinct from pharmaceutical approaches.

Broader nutritional support, crucial for individuals on or coming off GLP-1 RAs, formed another key area of innovation.

- Muscle mass support: The demand for preventing muscle wasting led to the showcase of various pure protein ingredients, including collagen peptides, alongside amino acids and creatine, vital for recovery and boosting lean muscle mass.

- Gut health: Solutions addressing digestive discomfort featured heavily. Examples included collagen peptides demonstrating efficacy in improving intestinal comfort and reducing bloating, alongside discussions on the role of probiotics and prebiotics for gut barrier support.

- Skin health: As discussed earlier for ‘Ozempic face,’ the industry is responding with ingredients like collagen peptides, hyaluronic acid, biotin, specific vitamins and minerals, and various botanical extracts, all designed to enhance skin elasticity, hydration and overall appearance.

While Rousselot presented specific ingredient solutions, the panel discussion broadened this scope, underscoring the general importance of dietary fibres for satiety and digestive wellbeing. Emerging ingredients, such as a hops bitterness extract, were also cited as potential novel solutions, though their wider market effectiveness remains to be seen.

From fewer than 100 launches in 2023 to over 3,000 in 2024 — GLP-1-labelled supplements are no longer niche.”

– Anova product database, presented by Rousselot

But conversations at Vitafoods were not just about physical ingredients, as panellists looked ahead to the exciting potential of digital integration and AI-driven solutions to revolutionise supplement regimens and meal planning for GLP-1 users. Such possibilities hint at a future where personalised nutrition is more accessible and effective than ever before.

Left to right: Jennifer Cooper, Mariette Abrahams and Bill Giebler discuss the impact of GLP-1 on the nutraceuticals industry with Informa’s Lucy Whittaker.

The evolving role of nutraceuticals: a long-term partnership

A powerful consensus emerged from the expert panel: the landscape of weight management has “fundamentally changed” and will not revert to previous trends. Jennifer Cooper asserted that we should no longer expect a return to “thermogenics and laxative teas,” indicating a permanent shift in consumer expectations and industry focus. This new paradigm positions the nutraceutical industry as “the healthy-lifestyle people,” uniquely poised to offer something crucial that pharmaceutical GLP-1s, with their short-term efficacy and potential for weight regain upon discontinuation, often miss: long-term, adjunctive support for sustainable healthy habits.

The emphasis was firmly on education and partnership. Instead of promising ‘natural Ozempic’ – a claim the panellists strongly cautioned against using due to a lack of scientific basis and potential regulatory backlash – the industry’s role should be to guide consumers in maintaining the weight loss they’ve achieved and fostering overall wellbeing. Bill Giebler highlighted a compelling survey, finding: consumers are overwhelmingly open to supplements that are “half as effective and cost half as much” if their weight loss goals are less drastic (eg, under 20lbs). This reinforces the demand for safer, more accessible and less aggressive solutions. The conversation underscored that while GLP-1 drugs might offer a rapid solution, the nutraceutical sector offers a crucial path to a healthier, more balanced lifestyle before, during and after their use.

Future outlook and regulatory considerations

Looking ahead, the energy at Vitafoods Europe painted a clear picture of an industry gearing up for significant transformation. The panel offered bold predictions for the prevalence of GLP-1-targeted products in the nutraceutical space by 2030, with estimates ranging from 47 percent (Bill Giebler) to a staggering 75 percent (Jennifer Cooper) of companies potentially offering a specific GLP-1 product or line. This signals not just market growth, but a profound reorientation of product development strategies.

However, with great opportunity comes the need for responsibility. Jennifer Cooper and the other panellists hinted at anticipated increased regulatory scrutiny and legal activity surrounding the use of GLP-1-related terms, particularly specific drug names like Ozempic or semaglutide, in product claims and marketing. This underscores the industry’s ongoing challenge to innovate while maintaining scientific integrity, transparency and consumer trust. The discourse at Vitafoods made it evident that the path forwards will require diligent research, robust clinical data and clear communication to consumers about the benefits and limitations of nutraceutical solutions in this rapidly evolving landscape.

A new era for supplements

Vitafoods Europe 2025 was a window into the future of weight management. The GLP-1 boom, far from threatening supplements, is fuelling innovation and reshaping the industry’s role. From supporting people on pharmaceutical GLP-1s to helping others take a more natural path, the nutraceutical sector is stepping into a new era. When Ozempic sponsored the 2025 Golden Globes and host Nikki Glaser quipped that it was “Ozempic’s biggest night,” this clearly signalled the enormous appeal of these drugs – not just as medical interventions but cosmetic aids too. The opportunity for nutraceuticals is thus indisputable and ripe for the taking. With a broad consumer base looking for modest, manageable weight loss without the intensity or side effects of injectables, supplements can position themselves to meet that need. The challenge now is to earn trust with clear evidence, thoughtful formulation and a long-term view of health. If the pharmaceutical GLP-1 boom marked the start of a new era, the supplement industry is ready to help shape what comes next.

Related topics

Regulation & Legislation, Research & development, Technology & Innovation, The consumer

Related regions

Related people

Bill Giebler, Florencia Moreno Torres, Jennifer Cooper, Mariette Abrahams