Understanding and addressing staff turnover in food and agriculture

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 20 December 2023 | Richard Volpe | No comments yet

Ricky Volpe analyses why staff turnover among the food and agriculture sectors is so high and suggests action the indsutry can take to improve it.

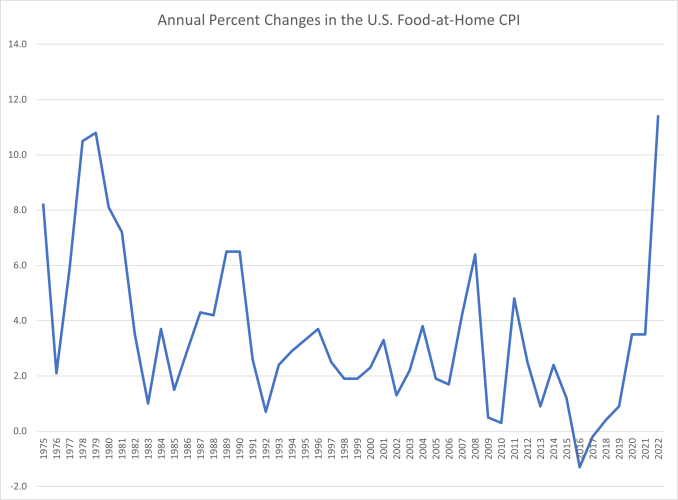

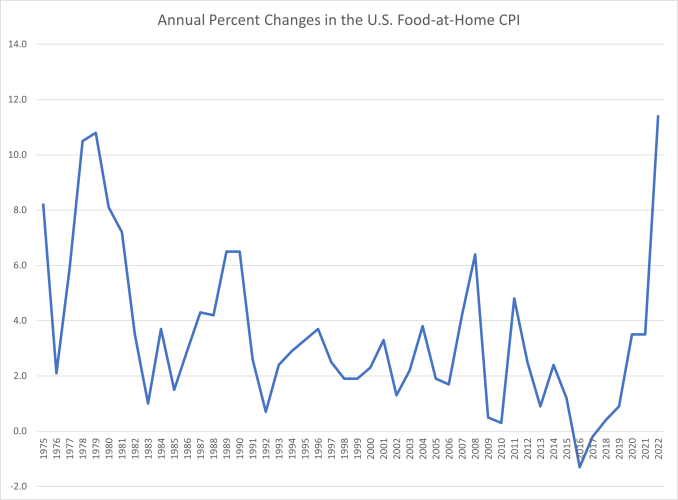

The historic retail food price inflation from 2020 to 2022 has left many of us searching for answers. The public and private sectors are seeking to design and implement solutions to stabilise and bolster the food supply, with the aim of ensuring safe, plentiful and affordable food for the citizens of the world. Understanding the drivers of the highest food price inflation that the Western world has seen since the late (Figure 1) is central to identifying where these solutions are most needed.

Largescale and unpredictable factors such as the COVID-19 pandemic and the war in Ukraine have been responsible for much of the food price inflation in recent years. But in many ways, these events have highlighted structural problems that, despite having worsened since 2020, have been affecting the performance and productivity of the global food system for much longer. One such issue is labour, which is proving to be challenging for employers at all stages of the food supply chain. Labour issues in production agriculture have been well documented for decades, owing to the physically challenging nature of the work, limited mobility, long hours, and pay that is not competitive with other industries. Yet labour issues extend beyond the production sector and must be addressed comprehensively and holistically.

Figure 1. Changes in the U.S. Food-at-Home CPI, 1975-2022

Source: Author’s calculations using data from the U.S. Bureau of Labor Statistics

The US state of California is home to one of the largest economies in the world and is considered the country’s most important state to the food sector, as it leads in agricultural production, food manufacturing and grocery sales. It therefore seems a logical place to investigate labour dynamics in the food system. Aside from labour shortages, which are difficult to measure using publicly-available information, perhaps the most valuable employment metric to industry is that of turnover. Turnover is a challenge as it is associated with search, hiring and replacement costs, as well as the loss of institutional knowledge, as workforces with high turnover rates are less likely to retain employees long enough to both amass and pass on valuable skills.

According to data from the US Census, It may surprise no one to learn that turnover rates are the highest among young workers – high school and college-aged workers – who are often seasonal and are working to earn spending money while studying for their degrees. Yet even for these groups, turnover has increased the most since the recession. This is problematic, as it suggests that food companies are finding it increasingly difficult to attract and retain young workers. For the grocery industry, in which supermarkets have struggled to maintain full employment since the onset of the pandemic, The increases are consistently high for all ages in the case of animal slaughtering, an industry that garnered many headlines during the pandemic due to shutdowns related to COVID-19 outbreaks and worker walkouts. These shutdowns, in turn, led to both food loss for ranchers and shortages for retailers. . This is consistent with the ageing workforces in agricultural production and trucking.

Table 1: Changes in Turnover Rates, by Age, for Selected California Food Industries, 2009-2021

|

14-18 |

19-21 |

22-24 |

25-34 |

35-44 |

45-54 |

55-64 |

65-99 |

|

|

Fruit and Tree Nut Farming |

7.99% |

10.13% |

5.15% |

-0.92% |

-6.85% |

-1.92% |

-10.82% |

-16.81% |

|

Animal Slaughtering |

79.16% |

52.30% |

71.43% |

55.98% |

73.03% |

74.13% |

55.49% |

27.38% |

|

Truck Transportation |

25.80% |

68.46% |

79.19% |

49.71% |

26.49% |

10.68% |

5.15% |

5.81% |

|

Food Manufacturing |

70.22% |

67.83% |

64.99% |

47.94% |

47.18% |

36.53% |

17.82% |

8.34% |

|

Grocery Stores |

85.21% |

87.25% |

70.42% |

49.41% |

52.61% |

46.63% |

20.55% |

20.84% |

|

Average |

53.68% |

57.20% |

58.24% |

40.43% |

38.49% |

33.21% |

17.64% |

9.11% |

Source: US Census, Quarterly Workforce Indicators

The question facing the food industry is thus: what can be done to reverse this trend and reduce turnover rates, to help ensure the sustainability of the supply chain? Wages are often cited in conversations on this topic, as the food industry is known to offer wages and benefits that are uncompetitive compared to other industries when holding experience and education constant. There are wage-related concerns even within the food sector. For example, next year California will put the Assembly Bill AB 1228 into law, which mandates a $20/hour minimum wage for fast food workers. This is driving concerns that employment for grocery stores will become scarcer.

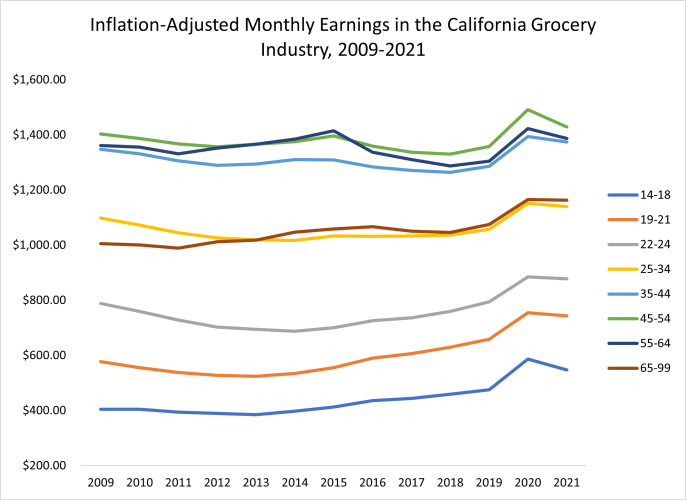

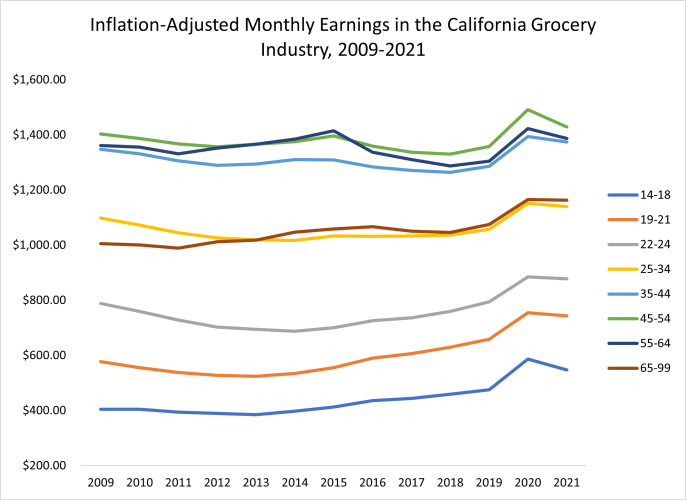

Landmark fast food bill passes through Californian legislature

The data reveals that wages are likely part of the problem, but there is surely more at play explaining turnover increases. In the grocery industry, where turnover has increased more than most other sectors, wages for workers aged 25 to 64 have been essentially flat since 2009 once adjusted for inflation (Figure 2). The surge in turnover rates for most food industries since 2009 suggests that increasing wages to reward longevity, productivity and education for mid-career workers is likely to yield a good return on investment. The situation is less clear for the youngest workers, however, whose pay has increased by far the most since 2009, largely due to minimum wage increases, but has also seen the largest increases in turnover rates. Younger workers, it appears, are looking for more than pecuniary rewards to attract them to food industries and keep them there.

Figure 2: Inflation-adjusted monthly earnings in the Californian grocery industry. Source: US Census, Quarterly Workforce Indicators

Solutions are needed now to reverse the surging turnover in the food supply chain, and ideas such as automation and expanded H-2A visas are costly, gradual in their development and proliferation, and tend to benefit upstream industries to a greater extent proportionally than retail and foodservice. Some ideas for success may be drawn from other industries that are more successful in attracting and retaining Gen Z and Millennials, such as technology and health services. Especially in the wake of the pandemic, younger workers are continuously demonstrating that they want flexible work schedules, remote work when applicable, opportunities for education and training, a clear path towards upward mobility, and to work for companies that share their values.

Naturally, employers such as grocery stores and food manufacturing plants are constrained somewhat in these areas. However, there are opportunities for food companies of all stripes to evolve with the times and improve their appeal to the new generation of workers. To address scheduling concerns, an array of platforms have emerged that allow workers to view and manage their schedules, enabling employees to request and swap shifts with one another with ease. There is potential for interested employees even in grocery stores or food manufacturing to work remotely part time, perhaps one or two days per pay-period, conducting tasks such as data analysis or marketing design, which often fall by the wayside during the busy daily tasks for food companies. Timelines for pay raises and promotions should be designed, agreed upon by management, and posted in places of work for all hires to see.

Implementations such as company mission statements have been shown to be effective in appealing to workers setting out on the job market, and should emphasise efforts towards diversity, inclusivity and sustainability. With respect to training, one low-cost idea worth considering is rotational programmes. Imagine a new hire in a supermarket who spends their first four weeks cycling through the store, working shifts in the deli, the bakery, the stockroom and the front end. This experience would grant them a comprehensive understanding of the operation, a variety of skills, and would demonstrate early on that the company is invested in their success.

About the author

Ricky Volpe received his Ph.D. in Agricultural and Resource Economics from UC Davis in 2010. He then spent four years working as an economist at the USDA Economic Research Service in Washington DC. There he researched a variety of topics, including food price formation, competitiveness in the food industry, and the healthiness of grocery purchases in the U.S. Ricky was also responsible for forecasting retail food price inflation at the national level.

Now at Cal Poly, Ricky teaches courses on food retail and supply chain management, transportation and logistics, and data analysis. He also maintains an active research agenda using a variety of large data sets to study issues related to market structure, firm performance, food prices, consumers’ food choices, and health outcomes. He also works closely with industry leaders in food retailing, wholesaling, and distribution to facilitate collaboration on public-private partnerships, student internships, and scholarships.