New and emerging sources of vegetable fats and oils

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 11 January 2013 | Guillermo Napolitano, Expert Scientist, Department of Science and Nutrition, Nestlé Product Technology Center | No comments yet

The science and technology of fats and oils is an extraordinarily active field for a number of good reasons. First, it includes a diverse collection of raw materials for a constantly evolving food industry. In addition, fats and oils ingredients influence every aspect of foods, from the mundane caloric content to the sophisticated mechanisms of metabolic regulation of functional ingredients or the crystal structure of a glossy chocolate.

The fat and oil industry provides the raw materials to cover all those needs for an increas – ingly demanding food sector (including the final consumer) using a discrete number of commodity and specialty oils. This is aided by modification techniques, such as hydrogenation (today mostly full compared to partial in the recent past), fractionation, interesterification and blending. The genetic modification of oleaginous crops, which has been practiced since ancient times through classical breeding, along with biotechnology and genetic manipulation are renewed additions to the tool kit of available technologies. This potential for innovation is exploited and reinforced by the market by constantly demanding new functionalities from oils or new oils for old functionalities.

The science and technology of fats and oils is an extraordinarily active field for a number of good reasons. First, it includes a diverse collection of raw materials for a constantly evolving food industry. In addition, fats and oils ingredients influence every aspect of foods, from the mundane caloric content to the sophisticated mechanisms of metabolic regulation of functional ingredients or the crystal structure of a glossy chocolate. The fat and oil industry provides the raw materials to cover all those needs for an increas - ingly demanding food sector (including the final consumer) using a discrete number of commodity and specialty oils. This is aided by modification techniques, such as hydrogenation (today mostly full compared to partial in the recent past), fractionation, interesterification and blending. The genetic modification of oleaginous crops, which has been practiced since ancient times through classical breeding, along with biotechnology and genetic manipulation are renewed additions to the tool kit of available technologies. This potential for innovation is exploited and reinforced by the market by constantly demanding new functionalities from oils or new oils for old functionalities.

The science and technology of fats and oils is an extraordinarily active field for a number of good reasons. First, it includes a diverse collection of raw materials for a constantly evolving food industry. In addition, fats and oils ingredients influence every aspect of foods, from the mundane caloric content to the sophisticated mechanisms of metabolic regulation of functional ingredients or the crystal structure of a glossy chocolate.

The fat and oil industry provides the raw materials to cover all those needs for an increas – ingly demanding food sector (including the final consumer) using a discrete number of commodity and specialty oils. This is aided by modification techniques, such as hydrogenation (today mostly full compared to partial in the recent past), fractionation, interesterification and blending. The genetic modification of oleaginous crops, which has been practiced since ancient times through classical breeding, along with biotechnology and genetic manipulation are renewed additions to the tool kit of available technologies. This potential for innovation is exploited and reinforced by the market by constantly demanding new functionalities from oils or new oils for old functionalities.

In the last 20 years, a number of develop ments have challenged the oil industry and promoted the emergence of new oils. Among those important developments, three closely simultaneous realisations can be singled out as having long lasting effects. First, the body of clinical and epidemiological evidence of the negative health impact of trans fatty acids and second, the recognition of the beneficial and conditionally essential roles of EPA and DHA (eicosapentaenoic and docosahexanoic acids) in human nutrition. Last but not least was the social and political recognition of environmental responsibility and sustainable use of vegetable oil resources (primarily palm oil).

These events have promoted the new uses of the traditional oil modification techniques and the development of oils from new sources. This article will briefly present the most salient of the new and emerging types and sources of edible vegetable oils in response to those needs.

Oils from microorganisms

Oil from microorganisms (also known as ‘single cell oils’ or SCO) can be derived from a wide range of unicellular organisms, including yeasts, fungi and algae1. These microorganisms can grow under different conditions, which in turn have a pronounced effect on the type and quantity of lipids formed. Microorganisms can grow extremely fast with doubling times of minutes to hours. This rapid reproduction is the raw material for spontaneous or chemically induced random mutations, which when followed by modern screening techniques lead to the identification of desired phenotypes. Microorganisms can be bio-engineered to express genes from other microorganisms, plants and animals. This process creates endless possibilities which at the moment are only limited by policies and consumers who may still be justifiably reluctant to accept ingredients derived from genetically modified organisms.

SCO are often described as ‘algal oils’, although this name should be only used when the source of the oil are photosynthetic autotrophic organism thriving at the very bottom of the food chain, biosynthesising organic matter from inorganic materials and sunlight. In most cases, however, these ‘algae’ are cultivated heterotrophically on pre-formed organic matter (e.g., sugar, glycerol, etc.) and micronutrients. These ‘algae’ are no longer green due to the loss of chlorophyll, but the process may still be considered environmentally ‘green’ when using agronomical by-products as a substrate.

Although SCO have been in the forefront of biotechnology for many years, their viability is restricted by the competition with low cost agronomical products. Therefore, SCO can be economically justified only for high price ingredients used in high value added final products, such as functional foods and infant formulas. Also, most of these SCO are derived from genetically modified sources, which might lead to low consumer acceptance in certain countries.

The first attempt to commercialise SCO was the production of γ-linolenic acid (GLA; 18:3n-6) from the fungus Mucor circinelloides. Although this pioneering microbial production of GLA was unsuccessful in competing with the established agricultural sources, it has set the technological and regulatory stage for further developments.

At the moment, the most successful examples of food applications of SCO are to replace the oils rich in the polyunsaturated fatty acids (PUFA); EPA and DHA are typically derived from marine fish, and oils rich in arachidonic acid (commonly derived from egg lecithin), both initiated by Martek (now DSM) in the 1990s. Both types of oils are used in food for the general population and also for infant foods.

There are two major advantages in pro – ducing marine n-3 rich PUFA from SCO (popularly known as omega-3 or ω3 fatty acids). One is that oils from fish (also from crustaceans and mollusks) may contain environmental contaminants such as petroleum derivatives, dioxins, furans, dioxin-like and non dioxin-like polychlorinated biphenyls (PCBs) and pesticides that will concentrate in the oil. In addition, it has been demonstrated that the recommended food intake of n-3 PUFA for the increasing world population cannot be sustained by declining fisheries. Therefore, n-3 PUFA from SCO and alternative sources emerge as a necessity.

SCO confined to large scale bio-fermenters can be grown anywhere and anytime during the year. This advantage, coupled with the microorganism’s phenomenal genetic potential, creates the opportunity for SCO to mimic the fatty acid and TAG composition of existing commodity oils and for developing new oils tailored for specific applications.

Recently, Solazyme communicated that they are able to tailor SCO suitable for many different food applications (W.R. Rakitsky, per. com). They developed SCOs enriched in either MCT or different long chain saturated fatty acids or oleic acid. Solazyme claim that they can produce SCO matching the fatty acid profiles of palm oil and cocoa butter. Two monumental challenges to compete with these traditional tropical oils are the low cost and the high output of the oil palm and the triacyl – glycerol stereospecificity of cocoa butter.

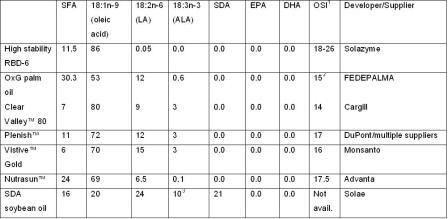

The technology to obtain a tailor-made fatty acid composition of commodity oils from microbes is certainly a breakthrough in the food industry. Even more interesting is that the ‘ideal’ fatty acid profiles that are currently not found in agricultural crops can be created as SCO. One of the examples is Solazyme’s high stability SCO containing approximately eight per cent (of total fatty acids) of palmitic acid, 86 per cent oleic acid and less than 0.5 per cent of the oxidation sensitive PUFA (Table 1). None of the high stability oils commercially available today have such a favourable oleic acid/PUFA ratio, which should result in unprecedented oxidation stability.

Palm oil

If one wants to jump to the opposite extreme of the spectrum from SCO’s taxonomic diversity, high reproduction rate, broad-based geo – graphic production and positive environmental image, palm oil comes to mind. The oil palm is an extremely productive crop that comes from one species, Elaeis guineensis, mainly from two countries (Malaysia and Indonesia), closely monitored by the public and NGOs for their environmental practices. Considering the above taxonomic and geographical homogeneity, it is not surprising that varieties of palm oils do not abound. At the moment, new palm oils in the market or under development are obtained by traditional cross-breeding of closely related species, specifically, the hybridisation of the commonly cultivated West African oil palm E. guineensis with the Latin American oil palm E. oleifera.

Commercially viable E. guineensis x E. oleifera (OxG) hybrids combine the high yield of the African oil palm with the oil composition of the Latin American counterpart. United Plantation Berhad has been producing a OxG palm oil for a number of years, characterised by a relatively high concentration of oleic acid (~50 per cent of total fatty acids). More recently, Fedepalma (Federación Nacional de Cultivadores de Palma de Aceite, Colombia), communicated the development of a locally produced OxG palm oil containing about 55 per cent oleic acid, 30 per cent SFA and 13 per cent PUFA (Table 1). This favourable fatty acid profile is complemented by reported high concentrations of valuable tocopherols, tocoptrienols and β-carotene. The availability and benefit of those components, however, is conditioned by their retention in the refined oil and by the consumer’s acceptability of the intense colour and strong flavour in mildly refined oils. Similar to the other mid to high oleic vegetable oils, this palm oil would be suitable for frying applications, or in virtue of its richness in lipid antioxidants and vitamins, are also marketed for nutritional applications.

High oleic oils

The US FDA rule on the trans fatty acids in nutrition labelling published in 2003 (enacted in 2006) had a strong effect in promoting the development of new fats and oils for the applications where TFA were preferred. The structural role previously provided by TFA-rich fats was in part replaced by palm oil and by other oils produced by the re-discovered process of interesterification.

Matching, or more realistically, approaching the oxidative stability of TFA-rich oils when solid fat was not needed found a different solution. This solution was provided by the development of a number of new and still emerging high oleic varieties of sunflower, safflower, canola and soybean oils. Mid and high-oleic sunflower, safflower and canola oils have been in the market for many years. New canola oils with increased concentrations of oleic acid have been recently introduced by major global suppliers. The first type of a high oleic soybean oil available at large scale is just out of the pipeline and waiting for global regulatory approval.

The ‘high oleic’ content in oils is associated with high stability oils. The high oleic acid content, however, does not automatically result in high oxidation stability. This stability is actually due to proportionally low concen – trations of the PUFA such as linoleic (LA) and α-linolenic acid (ALA), which have a 10 to 25 fold higher oxidation rate compared to oleic acid. The name ‘high-oleic low-linoleic’ would be more appropriate for these oils, though the market-friendly name ‘high oleic’ is more popular.

High oleic canola (HOC) dominates the market of high oleic oils that are reaching record production levels in 20122. The HOC trait was obtained by plant breeding techniques. Nevertheless, the products are GMO due to the secondary incorporation of herbicide (glyphosate) resistant genes. These oils are subjected to complex processes of seed production, identity preservation and logistics, and unlike their commodity counterpart, they are produced on demand.

Clear Valley® 80 is the latest development in a series of HOC oils, having a typical fatty acid composition of seven per cent SFA, 80 per cent oleic acid, nine per cent LA and three per cent ALA (Table 1, page 58). This reduction in the total PUFA level compared to their predecessors (Clear Valley® 65 and 75) resulted in a significant increase in the intrinsic oxidation stability (as predicted by an induction period of around 10 hours by the OSI method at 120°C). This intrinsic oxidation stability is also due to the presence of significant concentrations of endogenous γ-tocopherol. High oleic sunflower and safflower oils with similar levels of oleic and LA, and lower concentrations of ALA show lower oxidation stability, possibly due to the lower levels of γ-tocopherol. High oleic sun – flower and safflower oils are the choice where a non-GMO status is either preferred or required.

Soybean oil is the most abundant seed oil in the world and it is now entering the playground of high stability oil products. A prominent example is the GMO seed line developed by DuPont providing high oleic soybean oil (HOS) under the trade name Plenish™ (Table 1, page 58). Quantities of this new crop are currently limited and full expansion is awaiting global regulatory approval. Due to their many similarities, especially in terms of fatty acid comp ositions, HOS and its canola oil counterpart will be in direct competition as the preferred choice for thermally stable oils, shelf stable package foods and other uses. The typical fatty acid composition of Plenish™ is approximately SFA 11 per cent; oleic acid 75 per cent and PUFA 13 per cent (of which ALA is three per cent). This fatty acid composition and the presence of γ-tocopherol in this oil result in a relatively high oxidation stability (likely to reach around 12 hours by the OSI method at 120°C).

Adding to the landscape of new high oleic varieties is Monsanto’s glyphosate-resistant HOS Vistive™ Gold (SFA six per cent, oleic acid 70 per cent and PUFA 18 per cent, of which about three per cent is ALA), expected to be in the market in 2014 (Table 1, page 58).

High-stearic high-oleic acid sunflower oil

CSIC in Spain and Advanta Seeds of Argentina co-developed a high-stearic high-oleic sun – flower oil (HSHOSF) under the brand name Nutrasun™. This novel oil resembles the versatility of palm oil, in terms of the large number of potential applications. This high oleic (70 per cent) high stearic (18 per cent) oil brings new properties and functionalities: oxidation stability, a source of solid fat structure and the potential for fractionation; properties that were previously unheard from seed oils from temperate regions3. The significant SFA content of this oil is not a nutritional concern, since most of the SFA is stearic acid (Table 1, page 58), which does not increase the LDL-cholesterol in the blood stream.

The unique fatty acid composition of HSHOSF combined with the possibility of applying fractionation makes this oil potentially useful for many of the food applications previously covered by liquid and semisolid partially hydrogenated vegetable oils. HSHOSF hard stearines can be considered the first direct agricultural source of StOSt-type (stearic, oleic, stearic acid) triacylglycerols, highly valued components of cocoa butter alternatives.

Omega-3 fatty acids from agricultural sources

The agricultural source of omega-3 fatty acids is ALA. The conversion of ALA to the more biologically active EPA and DHA in humans is very slow and low and depends on ethnicity, gender and health condition. This conversion is considered to be insufficient to meet optimal growth and development needs. The bottleneck for the conversion of ALA to EPA is the activity of the Δ-6 desaturase that coverts ALA in stearidonic acid (SDA, 18:4n-3). Providing large quantities of ALA in the diet seems to promote its β-oxidation instead of its conversion to SDA. Therefore, providing preformed SDA in the diet would significantly increase its conversion to the more biologically active EPA in the body.

In a joint endeavor Monsanto and Solae developed a GM soybean oil rich in SDA under the brand name of Soymega™. SDA is produced from the oleic acid precursor in the soybean plastid by expressing the Δ-6 and Δ-15 desaturases genes from Primula juliae and Neurospora crassa respectively. Soymega™ contains 20-22 per cent SDA.

DHA is a major functional and structural component of the central nervous system and the eye. As for EPA, our proximate dietary source of DHA is seafood. As mentioned before, with fisheries reaching maximum capacity, the increasing demand for marine PUFA will meet serious environmental problems. In a recent collaboration, BASF and Cargill initiated the development of an agricultural source of DHA from rapeseeds. Though there will be significant technological and regulatory hurdles in this development, the DHA rich canola oil is expected to be available by the end of the decade.

Acknowledgements

The author thanks Constantin Bertoli and Jeta Kadamne for constructive comments to the manuscript.

References

1. Wynn, J.P. and Ratledge (2005). Oil from microorganism. In: Baley’s Industrial Oil and Fat Products. 6th edition, ch. 5

2. DeBonte, L., Iassonova, D. Liu, L. and Loh, W. (2012) Commercialization of high oleic canola oils. Lipid Technology 24 (8): 175-177

3. Bootello, M., A., Garces, R., Martinez Force, E. Salas, J. J. (2011) Dry fractionation and crystallization kinetics of high- oleic high-stearic sunflower oil. J. Am. Oil Chem. Soc.88:1511-1519

About the author

Dr. Guillermo E. Napolitano graduated from the Facultad de Ciencias Exactas y Naturales of the Universidad Nacional de Buenos Aires (Licenciado in Biológicas Sciences). He obtained a MSc and PhD from Dalhousie University, Halifax, Canada, specialising in marine lipids. Dr. Napolitano has extensive experience in the fields of analytical chemistry, biochemistry and technology of fats and oils and has numerous publications in the area of marine oils and technology of lipids. His current research focus is on the relationship between structure and function of lipids in foods. Since 1999 he is an Expert Scientist in the Department of Science and Nutrition at the Nestlé Product Technology Center in Marysville, Ohio, USA.