Savouring global growth in flavours

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 11 August 2006 | Jonathan Thomas, Senior Market Analyst, LFI | No comments yet

The international flavours industry is highly competitive, even more so in recent times as the world’s leading food companies become larger and exert more control over their ingredients purchasing arrangements.

In line with this, the flavours sector has itself consolidated, creating larger numbers of flavour giants with more diverse product ranges and greater geographical coverage in order to satisfy the demands of the world’s leading multinationals. There remain a number of significant medium to large flavour houses around the world, with the result that further consolidation in the coming years cannot be ruled out.

The international flavours industry is highly competitive, even more so in recent times as the world’s leading food companies become larger and exert more control over their ingredients purchasing arrangements. In line with this, the flavours sector has itself consolidated, creating larger numbers of flavour giants with more diverse product ranges and greater geographical coverage in order to satisfy the demands of the world’s leading multinationals. There remain a number of significant medium to large flavour houses around the world, with the result that further consolidation in the coming years cannot be ruled out.

The international flavours industry is highly competitive, even more so in recent times as the world’s leading food companies become larger and exert more control over their ingredients purchasing arrangements.

In line with this, the flavours sector has itself consolidated, creating larger numbers of flavour giants with more diverse product ranges and greater geographical coverage in order to satisfy the demands of the world’s leading multinationals. There remain a number of significant medium to large flavour houses around the world, with the result that further consolidation in the coming years cannot be ruled out.

There are several thousand flavouring agents available to the food industry, including both natural and synthetic products, with applications in all areas of the food and drinks market. While natural flavouring agents are often essential oils extracted from plants, the synthetics tend to be copies of natural components and include substances such as acids, aldehydes, esters and ketones. Flavours are generally classified as natural, nature-identical or synthetic.

In 2004, global usage of flavours, fragrances and essential oils were estimated at more than USD13bn in 2004, broken down by flavour compounds (45%), fragrances (40%) and essential oils (15%). Some broader definitions also include herbs and spices and the flavour chemicals used to make the flavour compounds. If these are included, global sales rise to within the region of USD19-20bn.

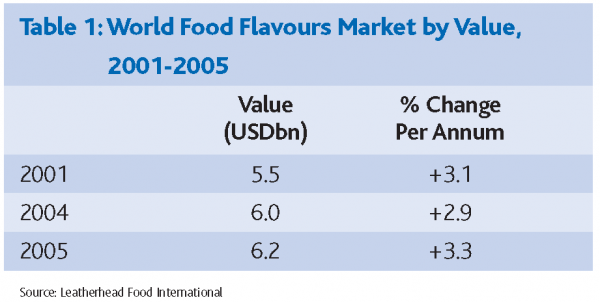

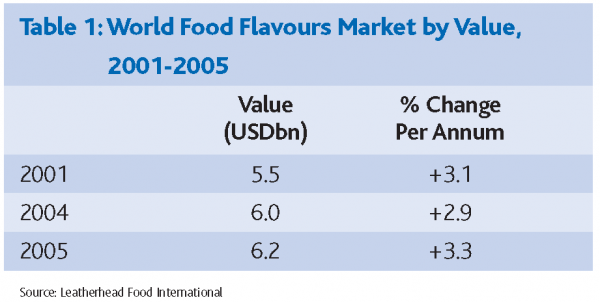

Within the total market, food usage accounted for around 45-50% at an estimated USD6bn in 2004, up from around USD5.5bn in 2001. In 2005, global market value was estimated at approximately USD6.2bn, up by more than 3% compared with the previous year (Table 1). Demand for flavours in the food industry is growing at a fairly steady rate, with new opportunities for flavours being developed all the time. However, consumer interest at present is focused on natural foods so, often, lightly flavoured or unflavoured products are chosen in preference to more strongly flavoured or synthetic products.

With sales in 2005 in the region of USD4.7bn, sweet flavours represent more than three-quarters (76%) of the market and savoury flavours the remainder. However, the savoury sector is displaying higher year-on-year growth, with an increased demand reported for ethnic and more strongly flavoured savoury foods across a broad range of food categories. For example, the crisps and savoury snacks market has seen great diversity of flavours in recent years, as consumers seek a wider variety than the basic salted or cheese flavoured snacks.

The soft drinks sector remains the most important single category for flavours, accounting for almost a third (31%) of usage on a global basis. Whilst demand for carbonated drinks is beginning to slow in some countries, levels of demand for flavours are being maintained through development in newer areas such as flavoured waters and sports and energy drinks. In addition, there is increased demand for flavours in the alcoholic beverages sector, where spirit- and beer-based FABs are becoming more widely available all the time.

Regionally, Europe, Africa and the Middle East represent approximately 40% of total flavours demand, with North America accounting for around 35%, Asia Pacific 15% and Latin America 10%. Asian markets are expected to increase their share in the coming years, as Chinese and Indian demand for more highly processed foods increases.

The top ten companies are estimated to account for more than 60% of the total flavour and fragrance category worldwide. Despite ongoing concentration in the industry, however, no single company takes more than approximately 16% of sales. In recent decades, the industry has become increasingly concentrated and there have been several important mergers and acquisitions. For example, in 2000, IFF acquired Bush Boake Allen, another of the world leaders. Meanwhile, the latest significant merger in the industry saw German companies Haarman & Reimer and Dragoco team up to form Symrise, which is now the number four in the global market.

The Swiss company Givaudan leads the international flavours and fragrances market, with a 16% share. The company was formed at the start of the 1990s via the merger between the Givaudan and Roure operations, and was formerly part of the international Roche group, but before being spun off. Its flavour sales are largely skewed towards Europe, Africa, the Middle East and North America, whilst recent acquisition activity has reflected upon the growing importance of savoury flavours. These have included the FIS – or Food Ingredients Specialities – business from Nestlé, as well as the International Bioflavors business based in the US, both of which occurred in 2002.

In second position with a 15% share is International Flavors & Fragrances (IFF). Since the Bush Boake Allen acquisition, much attention has been paid to streamlining the company’s operations. In 2004, IFF sold its fruit preparations activities in Europe (including operations in Switzerland, Germany and France) to the Israeli firm Frutarom, after which it closed its Canadian plant and switched production to two facilities in the US.

Other leading suppliers on the world stage include Firmenich which, like Givaudan, is headquartered in Switzerland. Firmenich operates three flavour units, namely Beverages, Sweet Goods and Savory Foods, and also acquired the Norwegian firm Bjørge Biomarin AS (which had been Europe’s leading producer of natural seafood extracts) in 2002. The following year, Symrise became the world’s fourth largest flavour business via the merger of the two largest German flavour companies – Haarman & Reimer and Dragoco. In 2005, Symrise built on its savoury flavour operations with the purchase of British flavour producer Flavours Direct.

Some of the world’s other major operators include Quest International (which is part of the ICI industrial group and is focusing more on flavours, having sold its more diverse food ingredients operations to the Kerry Group in 2004), Takasago (which is Japan’s leading flavour and fragrance company), Sensient Technologies (the name now used by the former Universal Foods group) and Danisco, which is currently expanding its flavour production in Asian countries such as Malaysia.

Innovation levels remain high in the global flavours market. In the confectionery sector, for example, flavour combinations are especially popular at present. In recent years, Wrigley has extended its Juicy Fruit brand with varieties such as Blulemberry (blueberry and lemon) and Raspermelon (raspberry and melon). Meanwhile, sour flavours (e.g. Green Apple) have been much in evidence in the sugar confectionery sector, particularly in the children’s products market. Turning to savoury snacks, flavour innovation has featured the emergence of unusual and exotic varieties, as well as the development of flavour profiles based on meals, such as Roast Lamb & Mint.

Turning to the future, bulk flavour growth is likely to be highest in the developing markets of the Asia Pacific and Latin American regions, particularly in highly populated countries such as China and India. The savoury flavours area is expected to witness the fastest growth, driven by flavour expansion in sectors such as savoury snacks and ready meals. Furthermore, growing consumer interest in ethnic foods is driving demand for stronger, spicier foods in a wide range of sectors. However, it should be noted that demand for flavoured carbonated soft drinks is likely to remain static, with more consumers switching to lighter flavoured products such as waters and fruit juice.