Fat bloom and cracking of filled chocolates: issues for the European manufacturer?

- Like

- Digg

- Del

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- Yummly

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Posted: 10 September 2009 | Frédéric Depypere, Claudia Delbaere, Nathalie De Clercq & Koen Dewettinck, Laboratory of Food Technology and Engineering, Ghent University | No comments yet

The European chocolate manufacturing market, comprising over 2,000 companies and employing more than 200,000 people, has an annual turnover of approximately EUR 43 billion and exports chocolate for a value of more than three billion Euros. Specific for the European market is the large proportion (over 90 per cent) of small and medium sized enterprises (SMEs) which compete against multinationals by producing exclusive and niche oriented products like filled chocolates.

The European chocolate manufacturing market, comprising over 2,000 companies and employing more than 200,000 people, has an annual turnover of approximately EUR 43 billion and exports chocolate for a value of more than three billion Euros. Specific for the European market is the large proportion (over 90 per cent) of small and medium sized enterprises (SMEs) which compete against multinationals by producing exclusive and niche oriented products like filled chocolates.

The European chocolate manufacturing market, comprising over 2,000 companies and employing more than 200,000 people, has an annual turnover of approximately EUR 43 billion and exports chocolate for a value of more than three billion Euros. Specific for the European market is the large proportion (over 90 per cent) of small and medium sized enterprises (SMEs) which compete against multinationals by producing exclusive and niche oriented products like filled chocolates.

Compared to plain chocolate bars, filled chocolates are more prone to quality problems due to the characteristics of the fillings and the possible incompatibility with the surrounding chocolate shell. Chocolate fat bloom, known as the loss of surface gloss, giving rise to a grey-whitish aspect, can be considered as the number one quality problem in this industry, leading to consumer rejection and a hampering chocolate export. In Figure 1, the occurrence of chocolate fat bloom is illustrated. Another reported quality problem is crack formation and crack propagation. This interruption of the chocolate shell may lead to the undesired spreading out of filling at the surface or even leakage.

In the EU 7th Framework Programme, the ProPraline project has recently started. ProPraline is a ‘Research for the benefit of SMEs’ project and forms in many ways a unique opportunity to tackle quality problems of the filled chocolates industry in a European context. For the first time, six European research institutes have joined forces to provide a global solution towards these quality problems. Moreover, research is performed in close contact with three SME associations, three SMEs and two large supplying companies, to translate the obtained scientific knowledge into practical solutions. In order to better understand the current European problems and practices, and to assure that the research efforts will be set up as closely as possible to real problems, a questionnaire for European producers of filled chocolate products was developed by Ghent University.

Questionnaire

A questionnaire was set up which addressed four major influencing factors with regard to the occurrence or prevention of filled chocolate quality problems such as fat bloom and cracking. A first section dealt with the composition of the filled chocolate product followed by a section with questions related to the production parameters. In a third section, the packaging and storage conditions were examined and in a final section, the relationship between quality problems and distribution was inquired.

An identical questionnaire was distributed among companies producing filled chocolate products in Belgium, Sweden and Switzerland. For Belgium, 21 companies, both SMEs and large companies, completed the questionnaire, accounting for a daily production of more than 160 tons. In addition, feedback was received from two chocolate suppliers, whose answers served as the ‘voice of the industry’ as they were in agreement with the individual answers of many of their customers. In both Sweden and Switzerland, answers from six producers of filled chocolates were obtained. The distribution of the Swiss companies’ chocolates production numbers was similar to that of the Belgian companies, ranging from a few hundred kilograms to 20 tons each day. In Sweden, however, only SMEs were interviewed, with lower daily production amounts, for most companies not exceeding 100 kilograms per day. Except for Sweden where large companies are also active in the production of filled chocolates, the set of completed questionnaires could be considered as representative for the current market situation. For Belgium and Switzerland, the number of completed questionnaires obtained was relatively high compared to the entire target group and the distribution of the company types who filled in the questionnaire was similar to the distribution within the whole target group. Questionnaires were completed by the companies on a voluntary basis, while being assured of an anonymous processing of their individual answers.

The sections below summarise the main findings. The results obtained from the Belgian questionnaires will be discussed in detail. From the questionnaires that were completed in Switzerland or Sweden, similarities and differences with respect to the contents of those from Belgium will be highlighted.

For which filled chocolates does fat bloom occur?

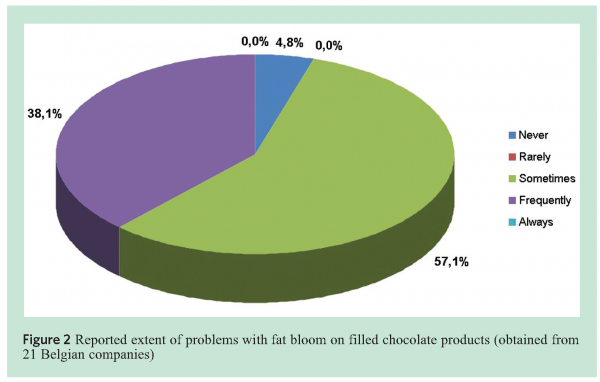

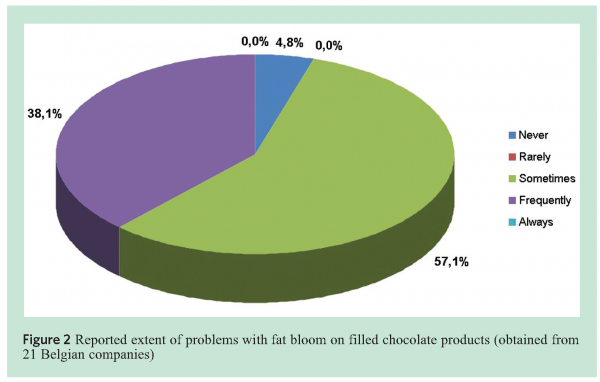

Almost all Belgian companies report to ‘sometimes’ or ‘frequently’ have problems regarding fat bloom on filled chocolate products (Figure 2). Only one Belgian company claimed to never have been confronted with fat bloom on their chocolates. All six Swiss companies indicated to ‘sometimes’ have problems with fat bloom on filled products. This is in contrast with the Swedish companies, of which two thirds ‘never’ face fat bloom problems while the other third is ‘rarely’ or ‘sometimes’ confronted with fat bloom. At this point, it is interesting to point out that whether or not fat bloom is perceived is related to the length of the distribution chain. While the Belgian and Swiss companies distribute to the local market as well as export worldwide, none of the Swedish companies indicated to export filled chocolates. For the latter, the chocolates are supposed to be consumed within a number of weeks after production, so usually before fat bloom occurs.

Concerning Belgian chocolates, the quality problems associated with fat bloom are mostly prevailing with milk chocolate: 49 per cent of the reported fat bloom cases deal with milk chocolate. Milk chocolate is closely followed by dark chocolate, with 41 per cent of the reported fat bloom cases. Much lower figures are obtained for white chocolate (eight per cent) and other (two per cent) composed chocolate products, such as chocolate coated biscuits, wafers, etc. The low figure for white chocolate may be partly explained by the fact that fat bloom that occurs on white chocolate leads to much less visual problems compared to bloom on milk or dark chocolate. If fat bloom occurs on white chocolate, it is hardly visible.

Ninety five per cent of the Belgian companies reporting fat bloom cases face this problem on milk chocolate. Particularly, problems are reported when nut based fillings (89 per cent of the Belgian companies) or a variety of fat (cocoa butter, palm, coconut, etc.) fillings (37 per cent) are combined with milk chocolate. Similarly, 80 per cent of the Belgian companies with fat bloom cases, face this problem (also) on dark chocolate. Again, fat bloom occurred the most when a nut based filling was combined with dark chocolate. The remainder of problematic fillings with dark chocolate were other fat fillings.

The companies were also asked which combination of chocolate and filling was fat bloom the fastest or the most abundantly observed. With respect to both questions, the combination of dark chocolate and nut (hazelnut, almond, etc) based filling was mentioned most often, closely followed by the combination of milk chocolate combined with a nut based filling. In Switzerland, very comparable information was obtained.

From many discussions with Belgian chocolate producing companies, the following common point could be distilled. In the 1990s, fat bloom problems were most often and severely reported with dark chocolate. Research has led to the suggestion of adding limited amounts of milk fat (butter oil) to the dark chocolate, which proved to be helpful. Nowadays, it seems that the problems have also shifted towards milk chocolate as some companies only face problems with milk chocolate.

What about the chocolate production?

Temperature and relative humidity control during chocolate production are important characteristics to avoid, e.g., melting and condensation problems. The average (± standard deviation) temperature reported at the beginning of the production line in Belgian companies is 20.6 ± 2.7 °C while this is 19.0 ± 2.3°C at the end of the production line. Fewer accurate figures are obtained for relative humidity, as can be seen from the relatively high standard deviation: 48.1 ± 11.5 per cent at the beginning of the production line versus 49.2 ± 8.6 per cent at the end of the production line. In Switzerland, comparable climate conditions are found (18.7°C – 51 per cent relative humidity) at the end of the production line. On the other hand, in Sweden, a somewhat higher average temperature at the end of the production line (20.3°C) occurs and it was found that the relative humidity was neither measured nor controlled and therefore is subjected to daily as well as seasonal variations.

Tempering is essential in chocolate production to assure that cocoa butter crystallises in the desired crystal polymorph. This in turn determines the chocolate contraction from the mould, the gloss appearance and the chocolate hardness and snap. For 80 per cent of the Belgian chocolate producers, the tempering of the chocolate is controlled by using a temper metre. The frequency with which this control is performed ranges from once a day to every 30 minutes. Comparable data were obtained from the Swiss companies while the Swedish companies interviewed either relied on the operation of automatic tempering machines (without control of the temper degree) or used thermometers in case of manual tempering. Of the Belgian producers, 65 per cent report to temper the fillings as well, in most of those cases (85 per cent) when cocoa butter is present. This is comparable to Swiss companies, and in contrast to the Swedish SMEs, of whom only 50 per cent regularly temper (selected) fillings. A good and quick indication of correct tempering is how easily the chocolate can be released from the mould. Eighty nine per cent reported that their chocolates always sufficiently demould, while 11 per cent report occasional problems with demoulding. These figures are similar for the Swiss and Swedish companies.

Depending on the size of the company, different types of cooling systems are used. While cooling tunnels and airflow coolers are used to handle large production volumes (Belgium, Switzerland), in Swedish SMEs, cooling also takes place in cold rooms. Many different cooling temperatures (ranging from seven to 20°C) and cooling times are reported and in many cases, the temperature of the cooling air changes between different sections of the cooling device. In general, knowledge on actual cooling air velocity is poor or limited.

The occurrence of cracks or surface irregularities in the chocolate shell can also be related to tempering and cooling. Twenty five per cent of the Belgian chocolate producers report to ‘never’ face those problems. They occur ‘rarely’ with 30 per cent and ‘sometimes’ with 45 per cent of the Belgian chocolate producers. Comparable figures are noted in Sweden (33 per cent ‘never’, 33 per cent ‘rarely’, 33 per cent ‘sometimes’) while a higher prevalence is found for the Swiss companies interviewed (33 per cent ‘rarely’, 50 per cent ‘sometimes’, 17 per cent ‘frequently’). Possible reported reasons for the occurrence of cracks or irregularities are deviations from the optimal process parameters, such as a too fast cooling. The cracking problem seems to be the most pronounced for dark chocolate.

Packaging and storage: is it child’s play?

The time of packaging after production is an important issue with respect to fat bloom. When products are packed too quickly, i.e., before sufficient crystallisation has occurred, fat bloom will arise from post-crystallisation, accompanied by heat release, in the package. Packaging immediately after production poses less of a problem when the chocolates are almost completely crystallised in the cooling sections of the production. Sixty five per cent of the Belgian companies report to always package immediately after production. Only 15 per cent report to exclusively store the chocolates for some days in conditioned rooms prior to packaging. Storage occurs in boxes or on trays and in many cases, a light protective plastic bag covers the chocolates. In the remaining 20 per cent of the Belgian companies, both practices (immediate packaging versus intermediate storage) are applicable, depending on the chocolate type (e.g., enrobing versus moulding chocolate). In Sweden and Switzerland, a larger proportion of the companies (~50 per cent) do not immediately package their chocolates after production. Intermediate storage times vary between one day and one month and storage temperatures vary between 12 and 20°C.

After packaging, the climate conditions, and more specifically the temperature and its fluctuations, during subsequent storage are of paramount importance. On average, the Belgian companies report a storage temperature of 16.2 ± 2.7°C and a relative humidity of 54.2 ± 8.9 per cent. In Switzerland and Sweden, the average storage temperature amounts are 15.5°C and 16.9°C, respectively. These temperature figures are relatively good with respect to the recommended value of 18°C. Besides this average temperature, its fluctuation over a period of time is equally important. In addition, previous research has already demonstrated that decreasing the storage temperature can lead to chocolates which are less prone to visual fat bloom. It is thus advisable to keep the storage temperature stable, preferably at 18°C or less.

Distribution key to visual bloom

Even when every aspect of the chocolate production process, including packaging and storage is controlled, chocolate fat bloom is likely to occur over time. By correct processing, however, the time before visual fat bloom occurs can be prolonged, surpassing the effective date of consumption. For a short distribution channel (local markets), visual fat bloom may not occur. Belgian companies mention that, on average, the fat bloom problem occurs after 4.5 months in the local market (with a distribution between 1 and 10 months). Fat bloom is, on average, even more quickly encountered upon export: after 3.5 months (distributed between one and eight months). Swiss companies report a similar time frame for exported products: on average after 4.5 months (distributed between one and nine months). It is clear that, given the above figures, Belgian and Swiss export of filled chocolates is seriously compromised. Swedish companies interviewed do not export and have a short product distribution chain, so visual fat bloom issues are hardly encountered.

What is known so far to be helpful?

Although bloom in chocolates has been studied for many decades, the specific mechanisms responsible for fat bloom remain largely unknown. The questionnaire results point out that we do not seem to properly control the fat bloom problem in the case of a long distribution channel. Should we therefore resign ourselves to the labelling on the chocolate packaging that the chocolates can turn grey-whitish, hereby informing the consumer that safety is not concerned?

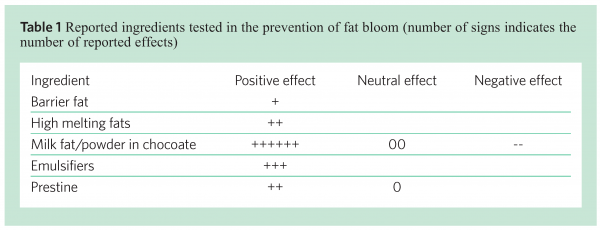

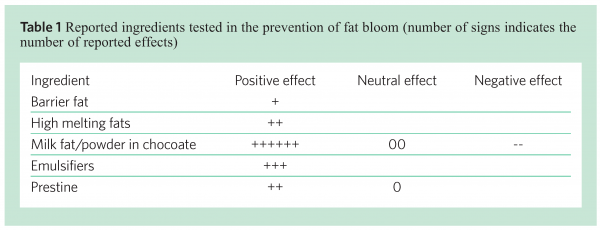

As an answer to this, so far many attempts have been performed to reduce or avoid visual fat bloom for a variety of filled chocolate systems. Modifications both on product level and on process level have been proposed. Table 1 indicates which specific ingredients have been tested in the prevention of fat bloom, as well as to which extent this has led to positive (+), neutral (0) or negative (-) effects. For instance, the use of milk components (milk fat (fractions) or milk powder) in dark chocolate has proven to retard/reduce fat bloom in six cases, but was found to have no or worse effects on fat bloom development in four cases.

Other mentioned possibilities to reduce or retard fat bloom development are lowering the percentage of nuts in the filling, building a thicker chocolate layer (e.g., double shell moulding), decreasing the production rate (lowering the band speed), adapting the tempering and cooling parameters, or including an extra cold storage period immediately after production in order to allow a quick further crystallisation and avoid unwanted slow post-crystallisation in the packaging. In practice, differences in the sensitivity towards fat bloom development of different production methods (moulding, enrobing, one-shot processing, frozen cone technology) are also encountered.

Conclusions

Fat bloom is a major quality problem for filled chocolates, especially when worldwide export is envisaged. This is the case for most of the Belgian and Swiss companies interviewed. Besides, the questionnaire has demonstrated that cracking is also an important quality issue, more specifically for the Swedish and Swiss companies interviewed.

The questionnaire has undoubtedly revealed the need for an integrated research approach in order to provide a global solution towards quality problems in filled chocolates. Therefore, the ProPraline project aims to understand the mechanisms of crack development and fat bloom growth in filled chocolates and to develop routes for its prevention. Through quantification of the process – structure – property relationships, the ProPraline projects aims at finding processing solutions for tailor-made cracking and fat bloom resistant chocolate microstructures.